Public Development Bank Climate Action Report

The Climate Policy Initiative (CPI) releases 2025 Public Development Bank Climate Action Report, aimed at analyzing the climate financing and commitments of public development banks.

The Climate Policy Initiative believes that public development banks are at the forefront of global climate action, and COP30 has established the PDB Guarantee Hub to expand climate financing.

Related Post: Climate Policy Initiative Releases Public Development Bank Carbon Market Report

Public Development Bank Climate Financing

Global climate financing needs to increase nearly fivefold from current levels by 2030 to meet the lower limit of market demand. Due to the limited role of private capital in climate financing, public development banks need to play a greater role. The G20 Sustainable Finance Working Group Agenda for 2025 and the Finance in Common Summit 2025 Communique both emphasize the importance of fully utilizing public development banks.

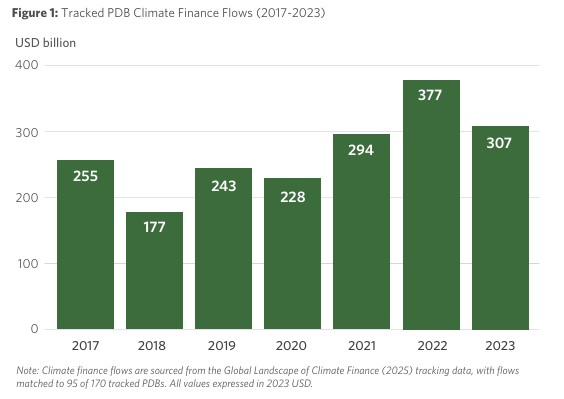

From 2017 to 2023, the climate financing scale of public development banks increased from $255 billion to $307 billion, reaching a peak of $377 billion in 2022. The reasons for the decline in financing in 2023 include shrinking public fiscal space and rising funding costs. From 2017 to 2023, the total scale of global climate financing is $1.8 trillion, mainly invested in the transportation industry ($614 billion) and energy systems ($479 billion). In the future, public development banks need to continue expanding their climate commitment and implementation capabilities to maintain growth in climate financing.

Public Development Bank Climate Commitments

The Climate Policy Initiative believes that the climate commitments of public development banks can be divided into two parts:

- Target: Willingness to achieve specific climate goals. Climate targets include Paris Agreement targets, net zero targets, carbon neutrality targets, and climate investment targets.

- Integration: Measures to incorporate climate factors into business actions. Measures include negative screening, divestment, counterparty guidance, etc.

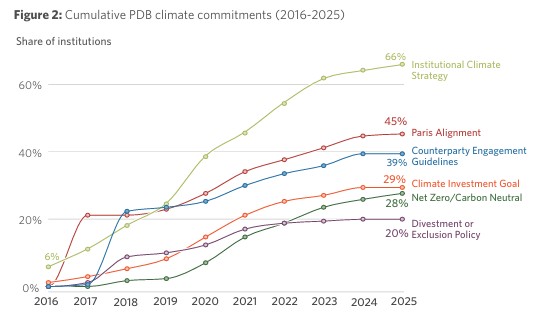

The Climate Policy Initiative analyzed climate commitment data from 170 global public development banks, with total assets of $21.9 trillion, accounting for 98% of the total assets of global public development banks. Since 2016, the climate commitments of public development banks have continued to grow, but the growth rate has slowed down since 2022. The main climate commitments implemented by public development banks in 2025 include Institutional Climate Strategy (66%), Paris Alignment (45%), and Counterparty Engagement Guidelines (39%).

In terms of the distribution of climate commitments in public development banks, the Climate Policy Initiative has established five different classifications, with the Paris Alignment representing institutions with stronger climate commitments and the Minimal representing weaker commitments. The climate commitments of public development banks in 2025 mainly fall into the latter two categories, with 36 institutions and 56 institutions respectively. Four institutions have been added to the categories with high climate commitments compared to 2024.

Climate Action Proposal of Public Development Bank

The Climate Policy Initiative believes that public development banks can expand climate action through the following ways:

- Jurisdiction issues climate action authorization to its own public development bank, develops a roadmap, and provides necessary tools and capabilities to enhance the bank’s climate commitment.

- Multilateral development financial institutions provide technical support to public development banks in setting climate targets, designing performance indicators, and helping banks develop clear and measurable climate goals, and building professional knowledge systems.

- Support large public development banks to participate in climate financing projects, provide credit enhancement products, and incorporate them into the climate financing system.

Reference: