2025 Asset Owner Sustainable Investment Report

The London Stock Exchange (LSEG) releases 2025 Asset Owner Sustainable Investment Report, which aims to summarize the sustainable investment actions of asset owners.

This report surveys 415 asset owners from 24 jurisdictions worldwide, with North America, Asia Pacific, and Europe accounting for 29%, 31%, and 40%, respectively. 24% of respondents had assets under management exceeding $100 billion.

Related Post: Morningstar Releases 2025 Asset Owner ESG Survey Report

Introduction to Asset Owner Sustainable Investment

By 2025, 80% of asset owners will incorporate sustainability factors into their strategic asset allocation process, nearly tripling compared to 2021. Despite pressure from stakeholders worldwide on attitudes towards sustainable investment, asset owners’ concerns about climate change risks continue to deepen, with 50% of investors worried about climate risks by 2023 and growing to 85% by 2025. In addition to climate change, asset owners’ priorities also include diversity and inclusivity (28%), climate transition risks (26%), customer responsibility (23%), human capital (21%), and biodiversity (20%).

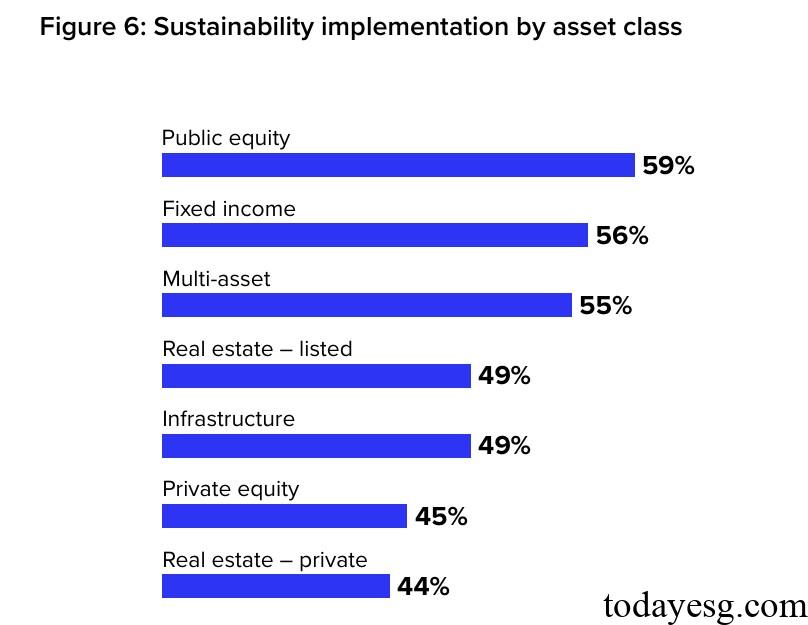

The sustainable investment practices of asset owners have remained stable in the past three years, accounting for an overall proportion of 73%. The proportion of sustainable investment to total assets is 41%. Next year’s expectation is 42%. From the perspective of asset categories, publicly traded equities (59%) and bonds (56%) account for a relatively high proportion, due to their large asset size and rich experience in sustainability. The reasons why respondents choose sustainable investment practices include achieving higher investment returns (56%) and reducing long-term investment risks (54%).

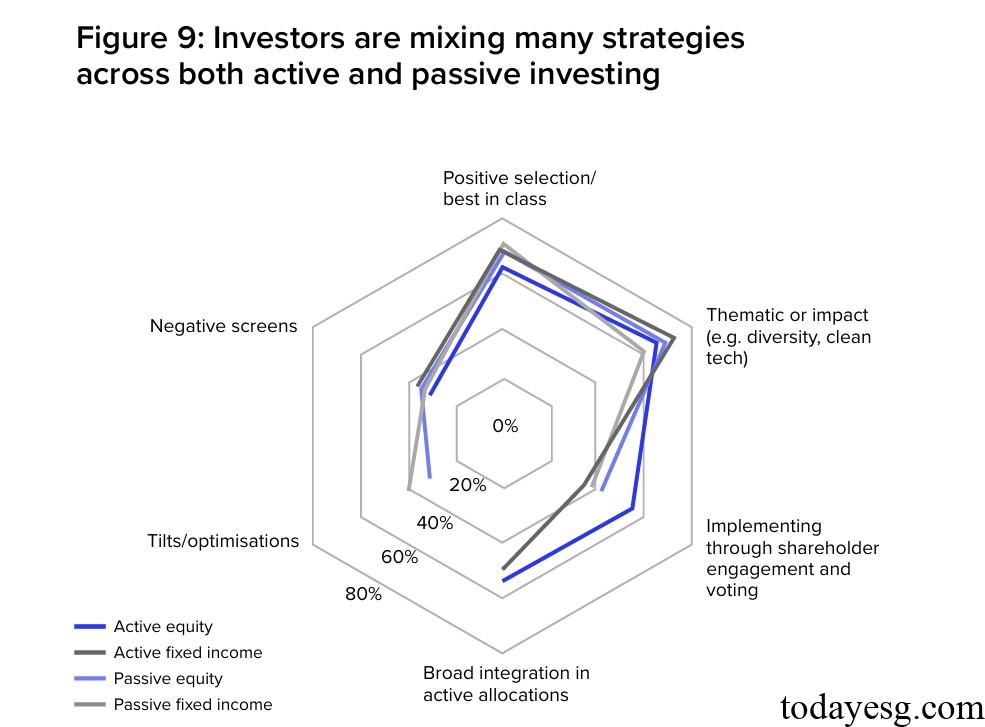

In terms of sustainable investment methods, respondents mainly choose ESG integration (61%), thematic ESG investment (60%), and climate risk (52%). The proportion of respondents applying exclusion methods has been decreasing year by year, and they tend to prefer more flexible asset selection and proactive management. For high carbon emission enterprises, choosing engagement (67%) is higher than directly withdrawing investment (21%). Theme investment and positive screening are more commonly used in passive investment, while engagement is more commonly used in active investment.

In terms of obstacles to sustainable investment, greenwashing risk (37%), ESG data availability (36%), and financial performance (27%) account for a relatively high proportion. Respondents believe that sustainable regulatory policies may be a driving factor for investment (22%) or a potential constraint (28%). 60% of investors believe that differences in information disclosure rules and classification systems have an impact on sustainable investment. The proportion of stakeholders holding negative and positive views on their needs is 23% and 13%, respectively.

Reference:

FTSE Russell’s 8th Annual Sustainable Investment Asset Owner Survey 2025