Internal Water Pricing Report for Enterprises

CDP (Carbon Disclosure Project) releases an internal water pricing report aimed at analyzing the role of internal water pricing in managing sustainable water resource risks for enterprises.

CDP believes that companies need to apply forward-looking water resource assessment methods in climate, regulatory, and supply chain risks. Internal water pricing can convert water resource risks into financial indicators, providing reference for enterprise decision-making.

Related Post: Alliance Bernstein Releases Sustainable Water Resource Management Investor Guide

Internal Water Pricing Survey for Enterprises

CDP collected the opinions of over 400 respondents on internal water pricing issues in a corporate questionnaire, including methods, goals, considerations and processes for internal water pricing, as well as price levels. 70% of respondents indicate that factors considered in internal water pricing include market prices, transportation costs, water treatment costs, disposal costs, and future water price expectations. Indirect factors that affect internal water pricing include sustainability guidelines, water resource targets, and social costs.

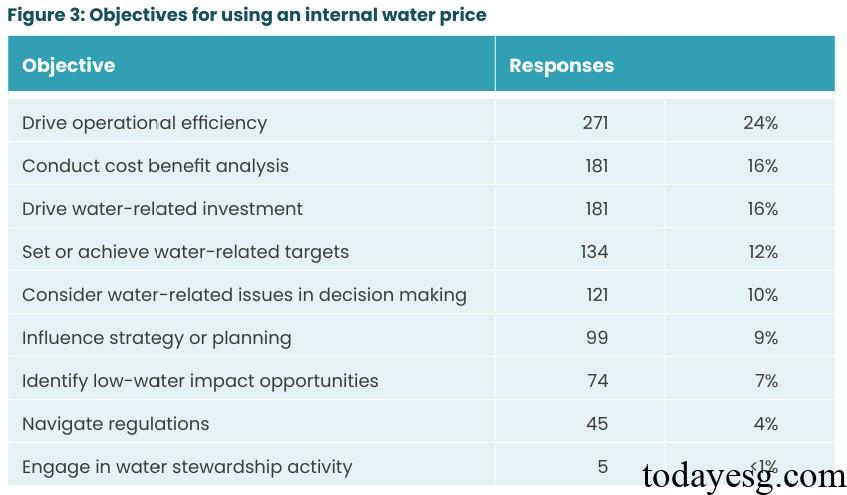

For using internal water pricing in enterprises, improving operational efficiency (24%), conducting cost-benefit analysis (16%), and estimating water resource investment (16%) account for a relatively high proportion. The purpose of internal water pricing varies in different industries. In the manufacturing industry, the main goals are operational efficiency and cost control, in the food industry, cost assessment, and in the materials industry, risk management. The internal water pricing scheme adopted by enterprises includes shadow pricing (43%), internal expenses (37%), and implicit pricing (20%).

The methods for setting internal water pricing in enterprises include:

- Cost Accounting and Benchmarking: Calculate water costs based on the true costs of procurement, processing, and disposal, as well as the impact of infrastructure, maintenance, and regulation.

- Operational Differentiation: Adopt differentiated pricing for different sites or facilities, reflecting regional water pressure, utility costs, or specific needs.

- Scenario and Risk Analysis: Use scenario models to predict the impact of water scarcity and inflation on water prices.

- Cost-Benefit Analysis: Calculate water prices based on capital expenditures and return on investment.

The application departments for internal water pricing in enterprises include:

- Operations department: Incorporate water pricing into business decision-making and resource management.

- Research department: Research low-risk water resource solutions.

- Procurement department: Sign procurement agreements in areas with high dependence on water resources.

- Risk management department: Quantify the commercial risks brought by water resources and incorporate water risks into the enterprise risk assessment framework.

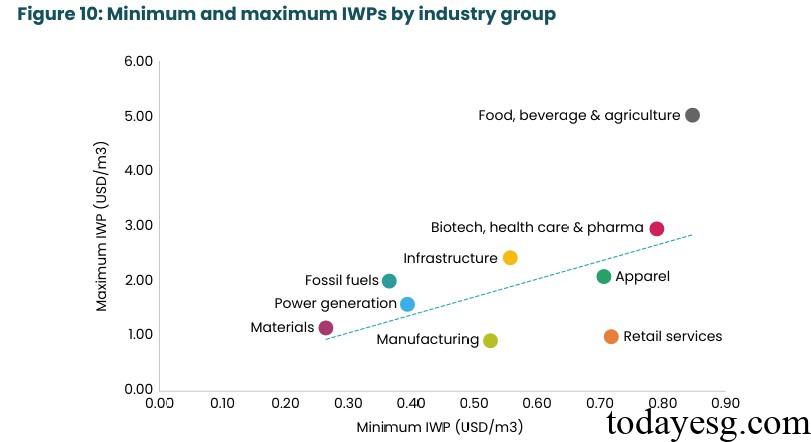

There are significant differences in the specific pricing of internal water among different countries and industries. Among 37 countries, the highest internal water pricing is $35.94 per cubic meter, and the lowest is $0.01 per cubic meter. In terms of industry, the water pricing in the food and biotechnology industries is relatively high, while the water pricing in the materials and manufacturing industries is relatively low.

Reference:

When Growth Gets Thirsty: Why Water Pricing Belongs in The Boardroom

ESG Advertisements Contact:todayesg@gmail.com