2025 Global Sustainability Disclosure Survey Report

PwC releases 2025 Global Sustainability Disclosure Survey report, aimed at summarizing the development of corporate sustainability disclosure.

PwC surveys nearly 500 companies in 40 jurisdictions worldwide, which disclose based on the European Union’s Corporate Sustainability Reporting Directive (CSRD) or the International Sustainability Standards Board Standards (ISSB Standards).

Related Post: Morgan Stanley Releases 2025 Corporate Sustainability Survey Report

Global Sustainability Disclosure Survey Results

The pressure for sustainable disclosure faced by enterprises is constantly increasing, with over half of respondents believing that the pressure to provide stakeholders from both external and internal sources is increasing. More than 60% of respondents have invested more time and resources into sustainable disclosure. Some multinational companies also need to handle the requirements of multiple jurisdictions simultaneously, considering the interoperability of different regulatory policies.

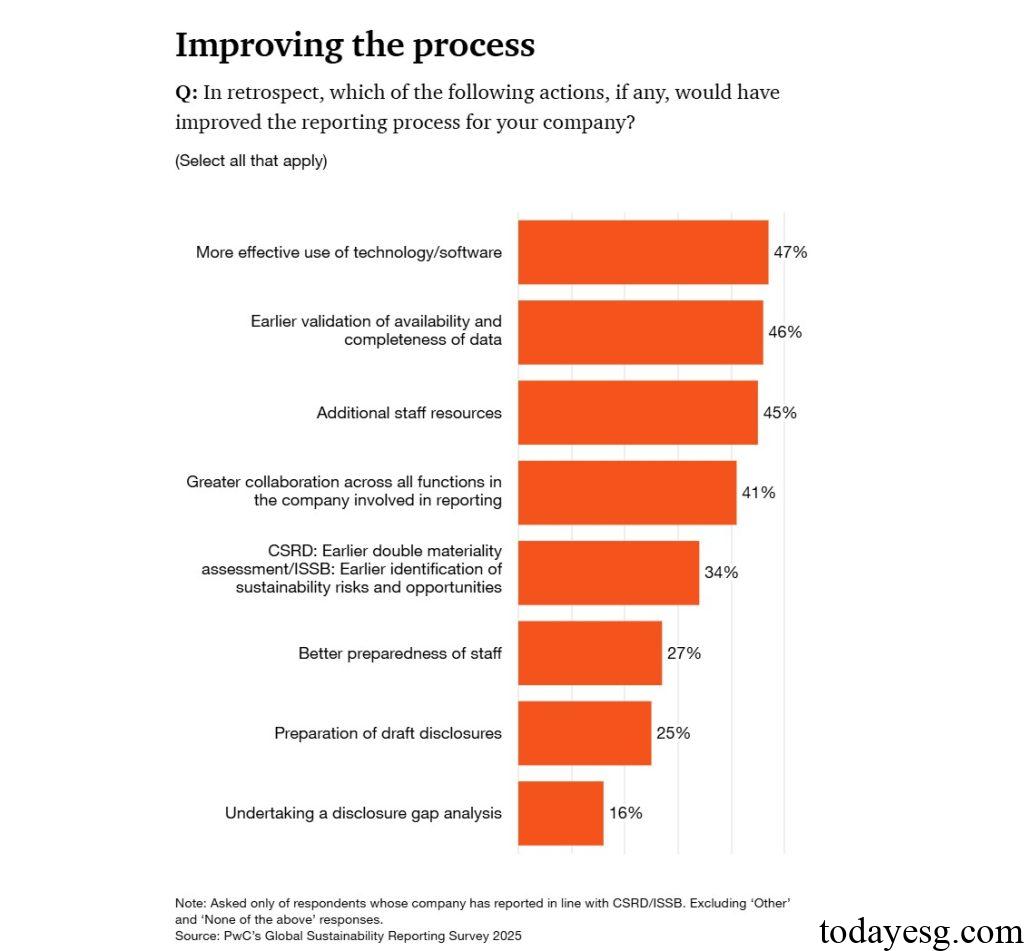

More than one-third of companies have already released sustainability reports, with 41% based on the Corporate Sustainability Reporting Directive and 23% based on the ISSB standards. Enterprises believe that factors that can improve the reporting process include more effective use of technology (47%), earlier confirmation of data availability and integrity (46%), and additional human resources (45%). In terms of collaboration in writing sustainability reports across different departments, ESG, human resources, and finance departments have been mentioned more frequently.

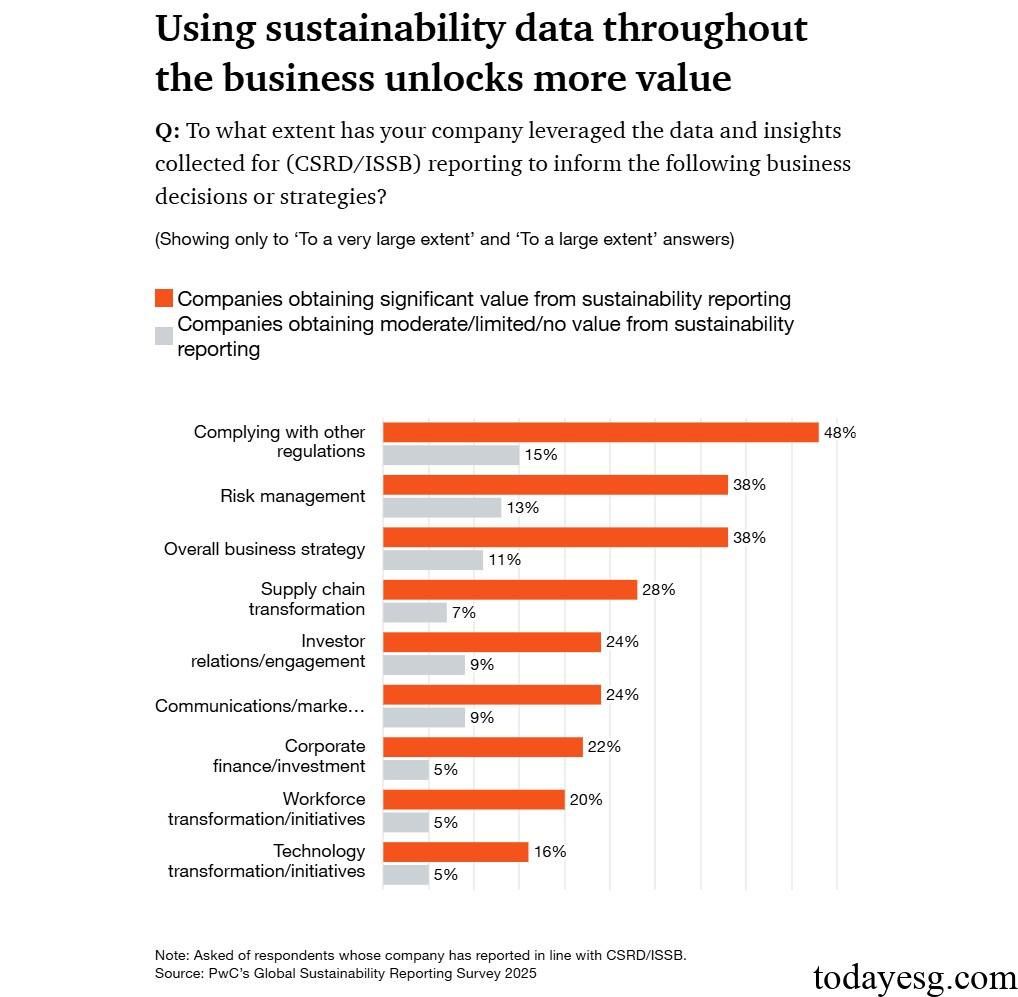

70% of companies believe that sustainable disclosure can bring value, with 28% considering it to be of great value. These enterprises incorporate sustainable insights in risk management (38%), business strategy (38%), and supply chain transformation (28%), with a higher proportion than other enterprises (13%, 11%, and 7%). More than half of the enterprises have increased their investment in sustainable technologies, with a high proportion of electronic spreadsheets, carbon emission accounting tools, and central sustainable data storage.

PwC believes that the challenges faced by companies in sustainable disclosure include:

- Sustainable report writing process: Enterprises need to establish an efficient and repeatable sustainable report writing process, prepare relevant infrastructure and tools, and establish a long-term sustainable disclosure system.

- Cross functional collaboration approach: In addition to collaborating on report writing, companies need to incorporate sustainable information into risk, supply chain, labor, strategy, and investment processes. Achieving this goal requires multi departmental collaboration.

- Senior management involvement: Senior management needs to participate in sustainable disclosure, understand relevant data and insights, and explore opportunities to create value.

Reference: