2025 H1 Global Sustainable Fund Report

The Morgan Stanley Institute for Sustainable Investing releases 2025 H1 Global Sustainable Fund Report, aimed at summarizing the development of the sustainable fund market.

As of June 2025, the total size of global sustainable funds has reached a historical high of 3.92 trillion US dollars, an increase of 11.5% compared to December last year. The total size of sustainable funds accounts for 6.7% of the total size of global funds.

Related Post: Morgan Stanley Releases 2024H2 Global Sustainable Fund Report

Global Sustainable Fund Flows

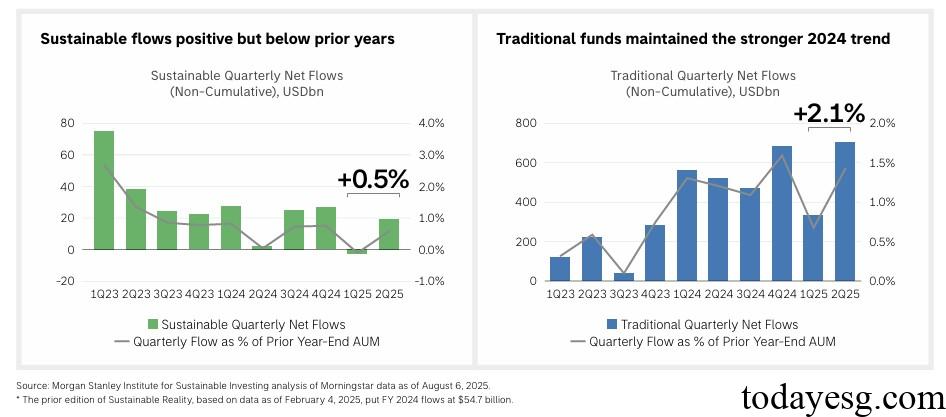

In the first half of 2025, the global sustainable fund had a net inflow of $16 billion, with a net outflow of $3.2 billion in the first quarter and a net inflow of $19.2 billion in the second quarter. Despite the overall positive flow of funds, the inflow of funds this year is significantly lower than in the past three years. In 2022 and 2023, the global sustainability fund has a net inflow of over $100 billion annually, and in 2024, the net inflow is $80.6 billion. The inflow of sustainable funds is also lower than that of traditional funds. In the first half of 2025, the net inflow of traditional funds reaches 2.1% of the total scale at the end of last year, while the net inflow of sustainable funds is 0.5% of the total scale at the end of last year.

In terms of regional classification, Europe and Asia recorded inflows of $24.7 billion and $2.7 billion, while North America recorded outflows of $11.3 billion. Currently, 88% of sustainable funds worldwide are registered in Europe, followed by North America (9%) and Asia (3%). Since the fourth quarter of 2022, the North American sustainable fund has experienced fund outflows for 11 consecutive quarters. From the analysis of capital flow and the proportion of sustainable fund size last year, Asia (3.9%) leads Europe (0.8%) and North America (-3.3%).

Global Sustainable Fund Returns

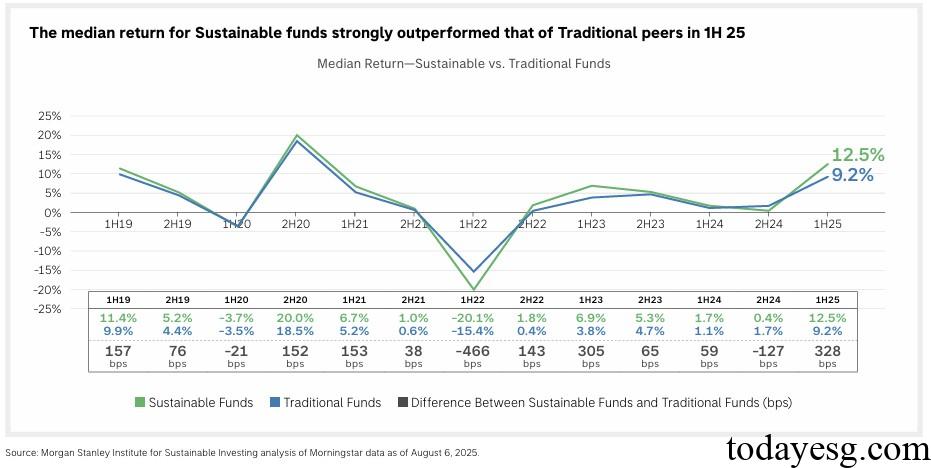

The median return of global sustainable funds in the first half of 2025 is 12.5%, while that of traditional funds is 9.2%, which is only lower than the second half of 2020. If investing $100 starting from December 2018, the sustainable fund will grow to $154 and the traditional fund will grow to $145 by June 2025. The European region has the highest return on sustainable funds, reaching 17.2%, followed by Asia (8.5%) and the Americas (4.6%). The downward deviation of sustainable funds in the first half of 2025 is -4.5%, while that of traditional funds is -5.5%, indicating that traditional funds are more likely to experience losses.

From the perspective of asset categories, the returns of sustainable stock funds, bond funds, and multi asset funds are 11.1%, 14%, and 13.2%, respectively, while the returns of traditional funds are 10.2%, 4.8%, and 10.3%, respectively. Sustainable bond funds perform significantly better than traditional funds, as BBB rated short-term, medium-term, and long-term sustainable bonds outperform traditional bonds. 92% of sustainable funds recorded positive returns in the first half of the year, higher than traditional funds (85%).

Reference:

Sustainable Investing Funds Beating Traditional Funds in 2025