Exchange Sustainable Development Research Report

The World Federation of Exchanges (WFE) releases a research report on sustainable development of exchanges, aimed at analyzing the environmental, social, and governance development of exchanges.

The World Federation of Exchanges analyzes the degree and type of ESG participation of 66 members over the past decade, as well as the role of ESG development and the economic, social, and institutional backgrounds of jurisdictions.

Related Post: World Federation of Exchanges Releases Report on Exchange Sustainability Survey

Background on Exchange Sustainable Development

The World Federation of Exchanges collects data at the exchange and jurisdictional levels, which comes from survey questionnaires of exchange members. The questionnaire information includes sustainable development plans, reports, and sustainable products in which the exchange participates.

The dependent variables include the allocation ratio of the exchange in terms of environment, society, and governance, as well as factors that promote the sustainable development of the exchange (sustainability issues, regulatory requirements, public relations, and competition issues, which are presented in the form of binary variables). The independent variables of the study include environmental, social, economic, and cultural information of jurisdiction, which is consistent with UN Sustainable Development Goals (UNSDGs).

Exchange Sustainable Development Findings

The World Federation of Exchanges analyzes the sustainable development of exchanges from the following perspectives:

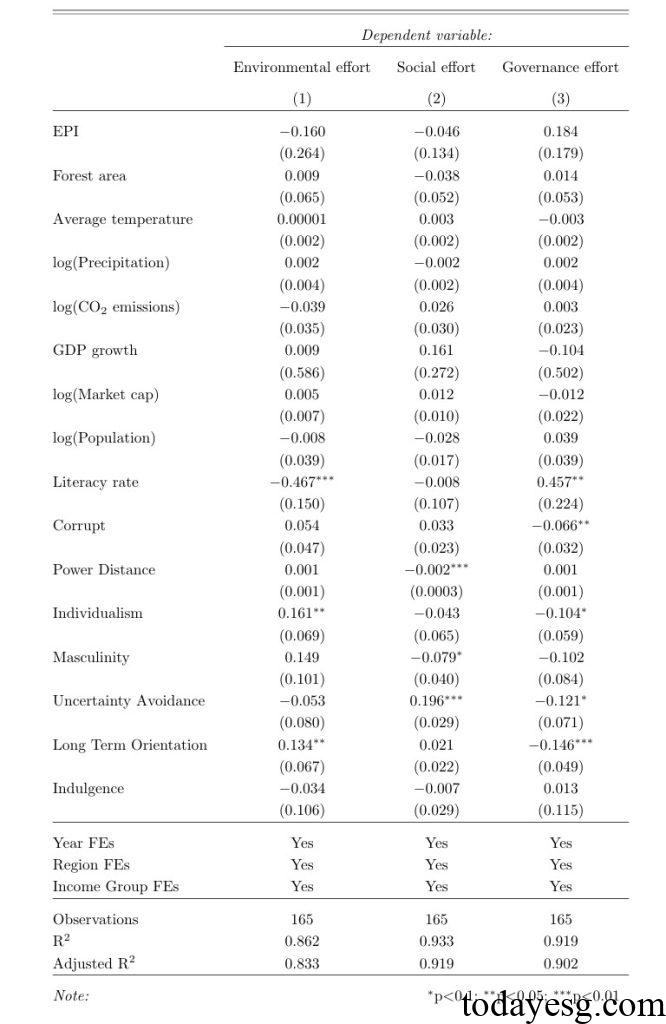

The driving factors of sustainable work in exchanges: The study analyzes the driving factors of three variables: environment, society, and governance. For each variable, the sum of its driving factors is 1. For example, in terms of environmental development, for one standard deviation increase in literacy rate, the exchange’s attention to environmental factors will decrease by 4.2 percentage points. The literacy rate has a positive driving effect on governance, but its impact on society is not significant.

The reasons why the exchange promotes sustainable development: From 2015 to 2023, sustainability issues and reputation are considered the most important factors by the exchange, indicating that meeting stakeholder requirements and establishing a sustainable image are the main considerations of the exchange. In contrast, regulatory requirements and competition between exchanges play a relatively small role in sustainable development.

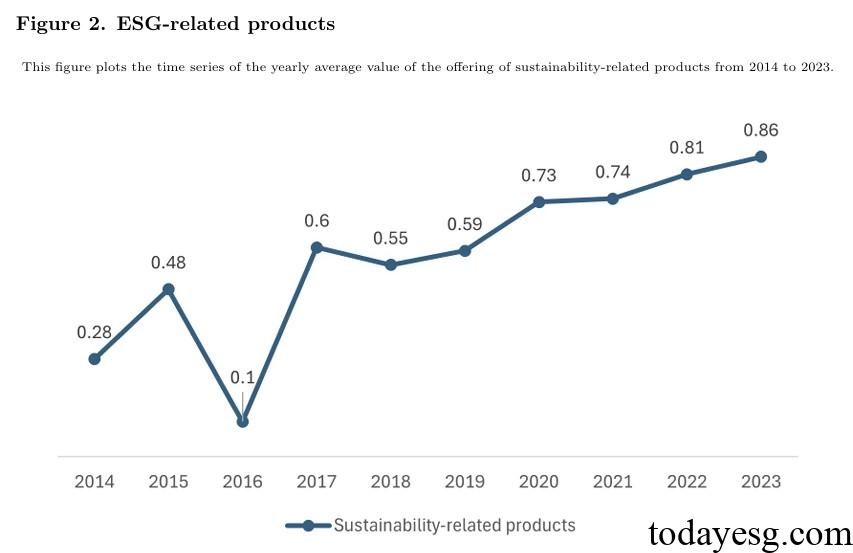

Development of Exchange ESG products: From 2014 to 2023, the overall trend of exchange ESG products has been on the rise, with their proportion increasing from 28% to 86%, indicating a continuous increase in market attention to ESG products. Regression analysis shows a significant positive correlation between environmental factors and the development of ESG products, and geographical features play an important role in ESG product development, such as jurisdictions with larger forest areas placing greater emphasis on sustainable development.

Reference: