2024 Hong Kong Sustainable Bond Report

The Climate Bonds Initiative (CBI) releases 2024 Hong Kong Sustainable Bond Report, which aims to summarize the development of the sustainable bond market in Hong Kong.

In 2021, Hong Kong released the Climate Action Plan 2050, which aims to reduce carbon emissions by 50% by 2035 (based on 2005) and achieve carbon neutrality by 2050. Hong Kong plans to invest HKD 240 billion in climate change mitigation and adaptation over the next 15 to 20 years.

Related Post: Introduction to Hong Kong Green Bond Program

Hong Kong Sustainable Bond Market Introduction

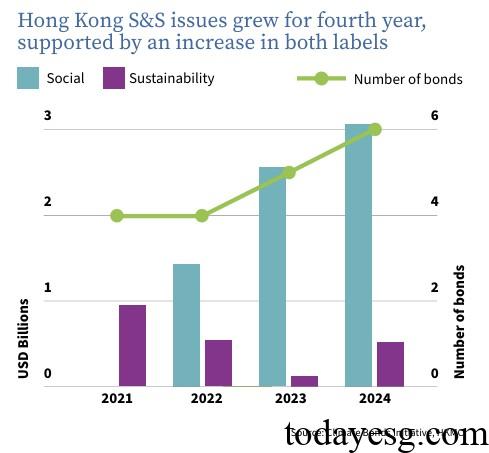

The issuance scale of Hong Kong’s sustainable bond market in 2024 is 10.8 billion US dollars, a year-on-year decrease of 41%. The reason for the decline is the decrease in the issuance scale of green bonds (7.2 billion US dollars, a year-on-year decrease of 54%), the increase in the issuance scale of social bonds (3.1 billion US dollars, a year-on-year increase of 20%), and the increase in the issuance scale of sustainable bonds (500 million US dollars, a year-on-year increase of 400%).

Since 2018, Hong Kong has been the largest center for green and sustainable bond issuance in Asia accounting for 45% of the Asian sustainable bond market in terms of issuance scale. Green bonds and sustainable development bonds account for 87% of the market share, while social bonds and sustainable development linked bonds have market shares of 12% and 1%, respectively. 80% of sustainable bonds in Hong Kong come from private sector issuers, with over half denominated in USD (58%), followed by CNY (33%) and HKD (5%).

Hong Kong Sustainable Bond Market Development

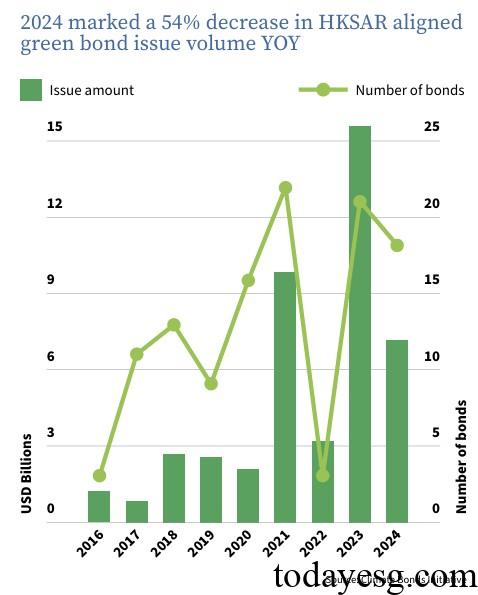

The issuance scale of Hong Kong green bonds in 2024 is 7.2 billion US dollars, with a total of 18 bonds. These bonds all comply with the green bond measurement method of the Climate Bond Initiative. If all green bonds are considered, the issuance size is $8.7 billion, and the number of bonds is 43. The reason for the decline in the issuance scale of green bonds in 2024 is that the number of bonds issued by the Hong Kong government has decreased, and the total issuance scale has dropped from the tenth place in the world to the twenty second place in the world.

The main purposes of raising funds for green bonds in 2024 are energy ($1.6 billion), transportation ($1.6 billion), and low-carbon buildings ($1.2 billion). Hong Kong is the preferred issuing location for China’s offshore green bonds, accounting for 36% of the total issuance scale in 2024. In 2024, Hong Kong will release sustainable finance taxonomy aimed at helping market participants make informed decisions in green and sustainable finance.

In 2024, Hong Kong social bonds and sustainable development bonds grew for the fourth consecutive year, reaching 3.6 billion US dollars, an increase of one-third compared to 2.7 billion US dollars in 2023. The Hong Kong government has issued its third social bond through the Hong Kong Mortgage Corporation Limited, which is also the largest social bond in the Asia Pacific region.

Hong Kong Sustainable Bond Market Recommendations

The Climate Bond Initiative provides the following recommendations for the sustainable bond market in Hong Kong:

- Utilizing policies and taxonomies for development: Issuers can increase issuance volume by aligning sustainable bond definitions, subsidies, and regulatory incentives. Investors can also expand their investment scope based on classification methods.

- Increasing adaptation and resilience financing: Relevant parties can refer to the Climate Bonds Resilience Taxonomy to increase the scale of sustainable bond issuance.

- Enhancing guidance on transition financing: In the future, the Hong Kong taxonomy may include guidelines for industries that are difficult to reduce carbon emissions, and issuers can also use transition plans to improve the credibility of bond information disclosure.

- Strengthen regional cooperation: Strengthen mutual recognition of classification standards between Hong Kong and the Asia Pacific region and build a sustainable financial center.

Reference: