IFRS Sustainable Disclosure Courses

IFRS launches free sustainable disclosure courses aimed at helping users understand how to apply IFRS S1 and IFRS S2.

All courses launched this time can be accessed through the electronic platform of the IFRS Sustainability Knowledge Hub.

Related Post: Nasdaq Carbon Academy Launches Five Free Carbon Courses

Introduction to IFRS Sustainable Disclosure Courses

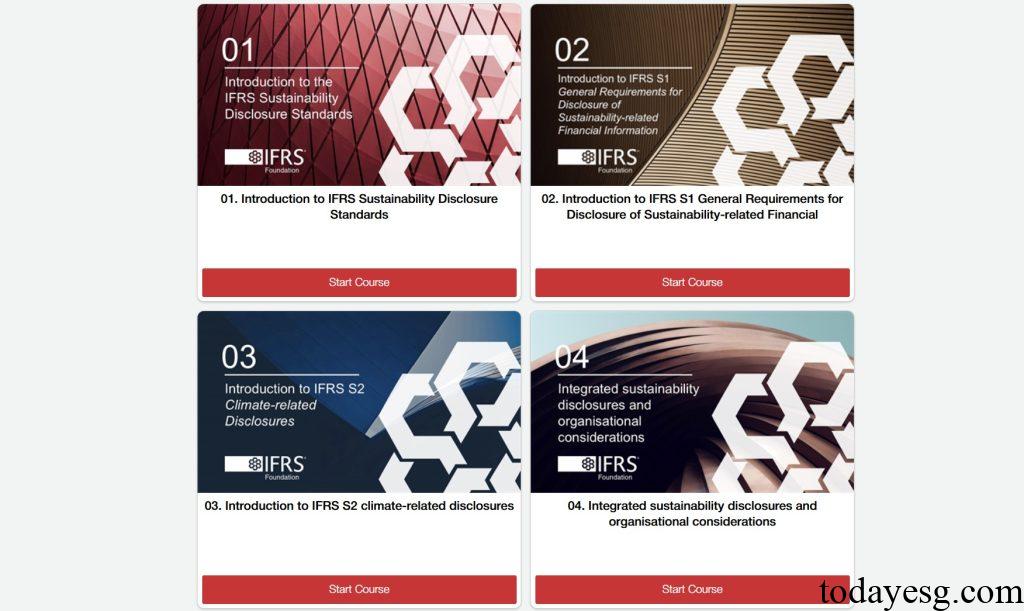

The IFRS Sustainable Disclosure courses consist of four parts, namely:

- Introduction to IFRS Sustainability Disclosure Standards: Understand the emergence and role of ISSB standards, as well as the actions of the International Sustainability Standards Board as standard setters. Master the objectives and sustainability related risks and opportunities of ISSB standards, as well as how to apply ISSB standards.

- Introduction to IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information: Introduce the content, structure, and concepts of IFRS S1, learn the characteristics of sustainable financial information, and master the core disclosure and basic requirements of IFRS S1. Understand the uncertainty and exemption clauses of sustainable disclosure.

- Introduction to IFRS S2 Climate-related Disclosures: Introduce the content, structure, and climate related risks and opportunities of IFRS S2. Master the core disclosure requirements of IFRS S2 governance, strategy, risk management, indicators, and objectives.

- Integrated Sustainability Disclosure and Organizational Considerations: Understand the impact of ISSB standards on businesses and learn how to reduce the gap between ISSB disclosure requirements and corporate information disclosure. Learn how to prepare for sustainable financial disclosures and how to establish a professional team to complete disclosures.

Each course includes learning objectives, test questions, and course feedback, and provides electronic materials to assist users in completing their studies. After reading all course content and passing the test (with an accuracy rate greater than 70%), users can obtain an electronic certificate.

Reference: