Green Bonds and Carbon Emissions Report

The Bank for International Settlements (BIS) releases a report on green bonds and carbon emissions, aiming to analyze the relationship between green bonds and carbon emissions.

This report explores two empirical questions regarding the relationship between green bonds and carbon emissions: whether regulatory policies promote the issuance of green bonds, and whether the issuance of green bonds will reduce carbon emissions.

Related Post: Introduction to Six Types of Green Bonds

Development of Global Green Bond Market

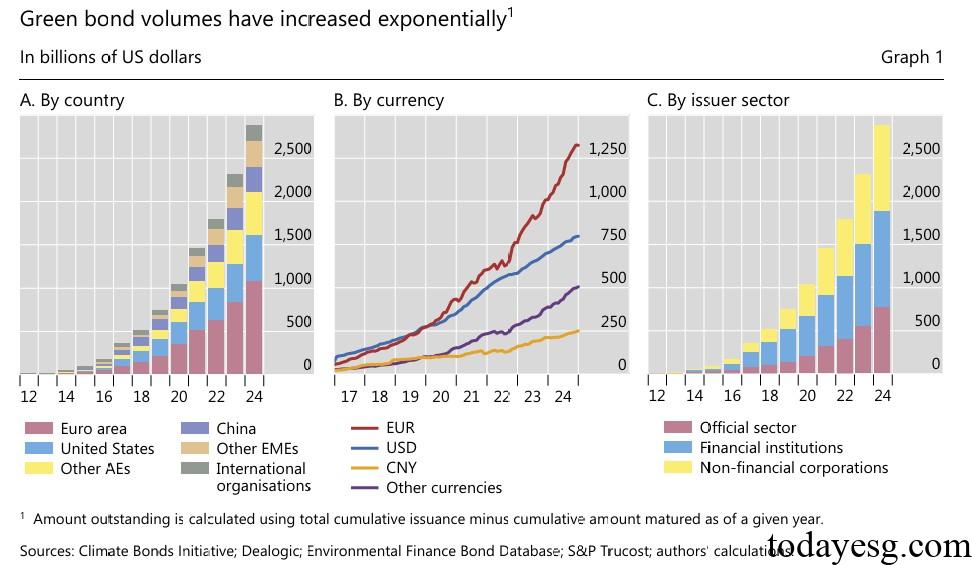

Since the International Capital Markets Association (ICMA) released the Green Bond Principles in 2015, global green bonds have been growing rapidly, reaching a total of $500 billion in 2018 and $2.9 trillion by the end of 2024. From the perspective of issuing regions, Europe, the United States, and China have a relatively high proportion, and the scale of bonds denominated in EUR, USD, and CNY is relatively large.

The growth of the global green bond market can be explained from two perspectives: demand and supply. From the demand perspective, investors are valuing sustainable investment, and green bonds are important sustainable financial instruments. Some institutional investors have incorporated ESG into their investment strategies and hope to hedge against carbon emissions risks. From the supply perspective, issuing green bonds by enterprises may result in a green premium and convey their sustainable development perspective to the market.

Will Regulatory Policy Promotes Green Bonds Issuance

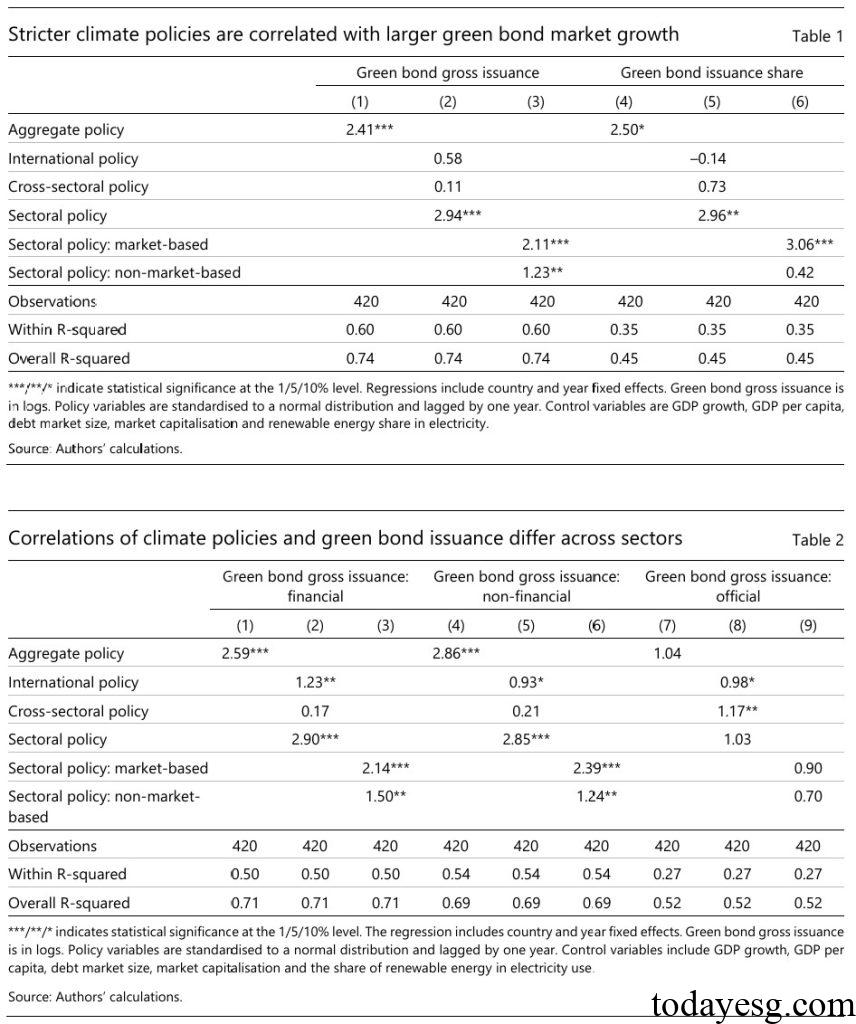

The Bank for International Settlements uses data from 39 jurisdictions from 2011 to 2022 to analyze whether stricter climate policies will incentivize companies to issue green bonds. The analysis results show that there is a positive correlation between the strictness of regulatory policies and the size of green bond markets in various countries. For every standard deviation increase in overall strictness, the annual issuance of green bonds increases by 2.4%. Different policies have varying degrees of promotion for green bonds, for example, specific industry policies can increase the annual issuance of green bonds by 3%.

In the robustness test, the BIS repeated the regression analysis using data from both the financial and non-financial industries and obtained similar results. However, the significance of the impact of general policies and industry-specific policies on different industries varies, which may be because general policies promote the issuance of government green bonds, while industry-specific policies primarily affect specific industries. Therefore, regulatory policies can promote the issuance of green bonds.

Will Green Bonds Issuance Reduces Carbon Emissions

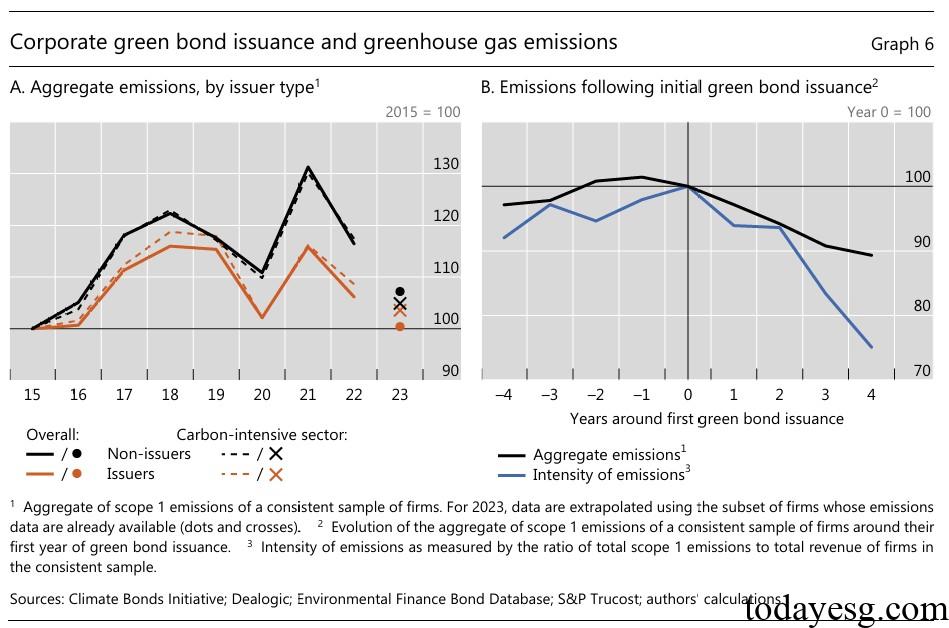

The Bank for International Settlements first analyzes the relationship between corporate green bond issuance and greenhouse gas emissions. From the analysis of carbon emission data from both issuers and non-issuers, regardless of whether the company issues green bonds or not, its total carbon emissions have increased in the past decade and reached a peak in 2021. However, the peak carbon emissions of green bond issuers are lower than those of non-issuers.

After the company issued its first green bond, its carbon emissions decreased by an average of 10% and carbon intensity decreased by 25% within four years. However, the decrease in corporate carbon emissions can also be attributed to their own carbon reduction commitments and actions, and green bonds are just one of the signals.

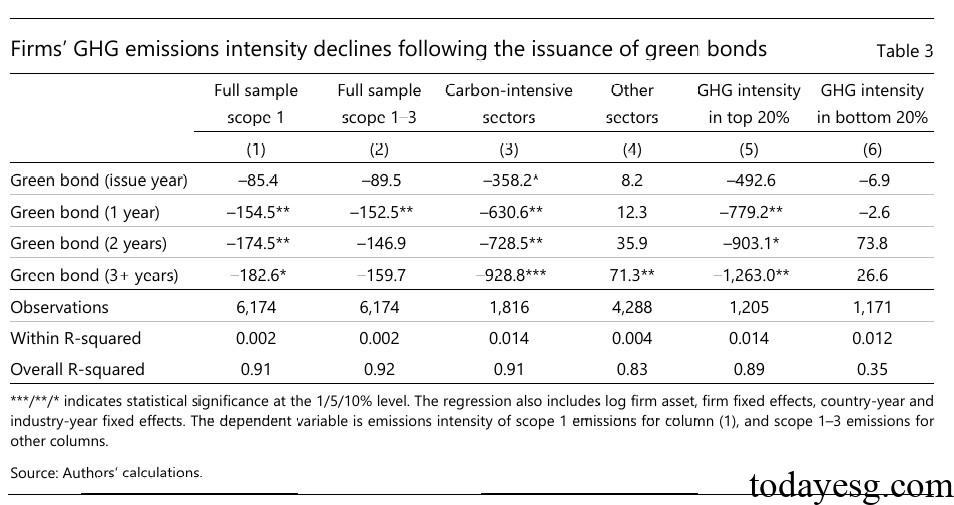

The Bank for International Settlements measures the relationship between greenhouse gas emission intensity of green bond issuers and green bonds through regression analysis. From the analysis of the results, for Scope 1 carbon emissions, the emission intensity of the company decreased by 21% one year after issuing green bonds, and the change in emission intensity remained significant three years after issuing green bonds. In addition, after carbon intensive industries issue green bonds, other carbon emission intensities decrease more significantly, and the data of the top 20% of carbon emission groups also show this characteristic. Therefore, for carbon intensive enterprises, issuing green bonds can reduce carbon emissions.

Reference:

Growth of the Green Bond Market and Greenhouse Gas Emissions