Sustainable Fund Market Report

The International Capital Market Association (ICMA) releases a sustainable fund market report, aimed at summarizing the development of the sustainable fund market.

The International Capital Market Association believes that the sustainable fund market is growing rapidly, but it has also raised concerns among investors about the risk of greenwashing. Some regulatory agencies are taking measures to revise sustainable fund regulatory policies and improve market integrity.

Related Post: International Capital Market Association Releases Greenwashing Report on Sustainable Finance

Sustainable Fund Market Development

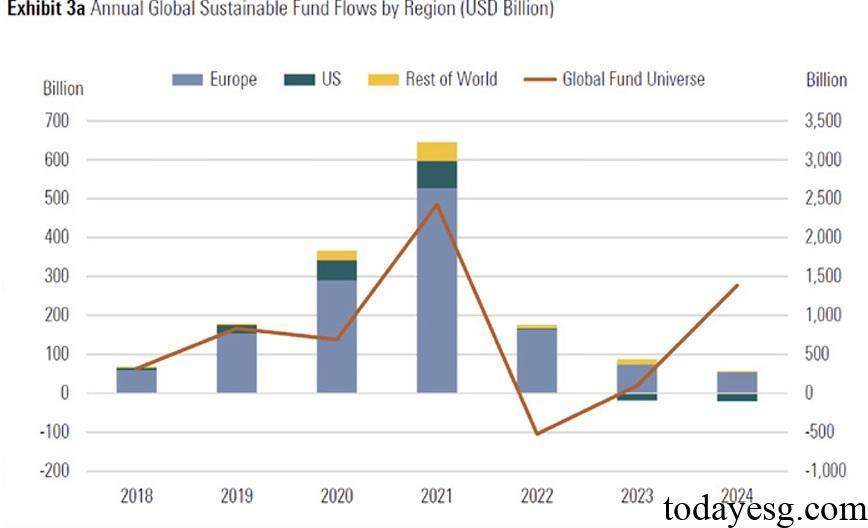

The total assets of the global sustainable fund have exceeded 3.3 trillion US dollars, of which over 2.7 trillion US dollars are in Europe. Since 2022, macroeconomic development and high-interest rate environment have affected the clean energy industry, which has had a certain impact on the flow of ESG funds. The tightening of ESG regulatory policies and investors’ requirements for financial returns have led to a gradual decline in the inflow of funds into global sustainable funds over the past three years.

The launch speed of new sustainable funds has decreased from 573 in 2023 to 311 in 2024, which is directly related to the tightening of the naming policy for sustainable funds. Europe has the highest total number of sustainable funds in the world, with 351 funds being closed in 2024, an increase of 40% year-on-year. 62 funds cancelled their ESG names in the fourth quarter of 2024. If the ESG fund naming rules of the European Securities and Markets Authority (ESMA) apply from May 2025, 30% to 50% of sustainable funds may continue to change their names in the future.

Greenwashing in Sustainable Fund Market

The development of the sustainable fund market has also led regulatory agencies and investors to pay attention to its greenwashing risks. The International Organization of Securities Commissions (IOSCO) believes that fund greenwashing refers to the inconsistency between fund names and investment objectives, failure of fund marketing to reflect investment strategies, and lack of disclosure and misleading statements regarding sustainable performance and results.

The International Capital Markets Association believes that the factors contributing to these greenwashing risks include the difficulty of sustainable investment methods, marketing pressures in a competitive environment, and regulatory frameworks neglecting greenwashing risks. Although some jurisdictions have acted against asset management companies’ greenwashing practices, there are significant differences in the number and situation of greenwashing cases currently.

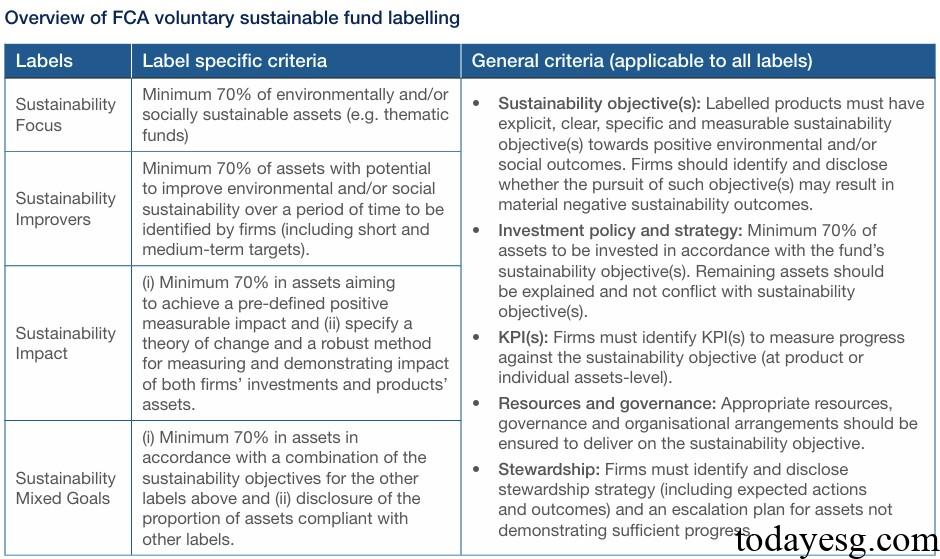

In response to greenwashing, regulatory agencies have also classified sustainable funds and put forward different requirements. For example, the European Sustainable Finance Disclosure Regulation (SFDR) divides funds into Article 6, Article 8, and Article 9 funds, with Article 8 and Article 9 funds referred to as light green and dark green funds. The UK Financial Conduct Authority has also introduced anti greenwashing rules in its Sustainability Disclosure Requirements (SDR) and proposed several voluntary fund labels.

ICMA’s Suggestions for Sustainable Fund Market

Considering the development of the sustainable fund market and the risk of greenwashing it faces, the International Capital Market Association proposes the following recommendations:

- The regulatory policies for sustainable funds should be consistent, such as providing consistent disclosure indicators for sustainable fund. If different regulatory requirements coexist, the compliance cost of funds will increase, and the difficulty for investors to obtain information will also increase.

- The classification standards for sustainable funds in different regions should consider interoperability and whether other classification methods are applicable to maintain the investment scope of sustainable funds and attract investors.

- For asset classes that are excluded from the investment scope of some sustainable funds (such as transition assets), regulatory agencies need to develop corresponding guidelines to promote their transition and reduce the risk of fund greenwashing.

Reference: