Asian International Sustainable Bond Market

The International Capital Market Association (ICMA) releases a report on the Asian international sustainable bond market, aimed at analyzing the development of the Asian international sustainable bond market.

The ICMA believes that the international sustainable bond market is an important part of the Asian bond market, accounting for 21% of the total issuance in 2024, which is more than twice the proportion of sustainable bonds in other regions.

Related Post: World Economic Forum Releases Asian Net Zero Transition Bond Market Report

Asian International Sustainable Bond Market Development

The ICMA collectively refers to green bonds, social bonds, sustainable bonds, and sustainable linked bonds as sustainable bonds, and has released multiple frameworks for sustainable bonds. These frameworks include the Green Bond Principles, Social Bond Principles, Sustainability Bond Guidelines, Sustainability Linked Bond Principles, and the Climate Transition Finance Handbook. Currently, 97% of global sustainable bonds are issued based on these frameworks.

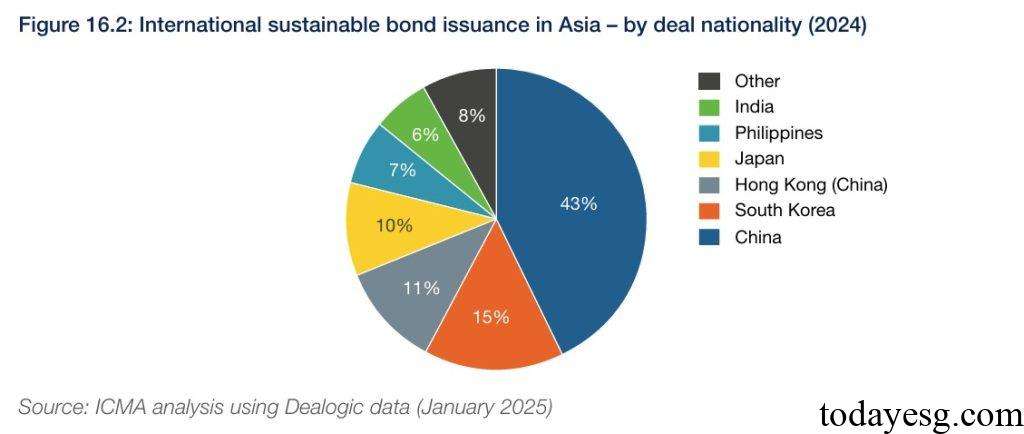

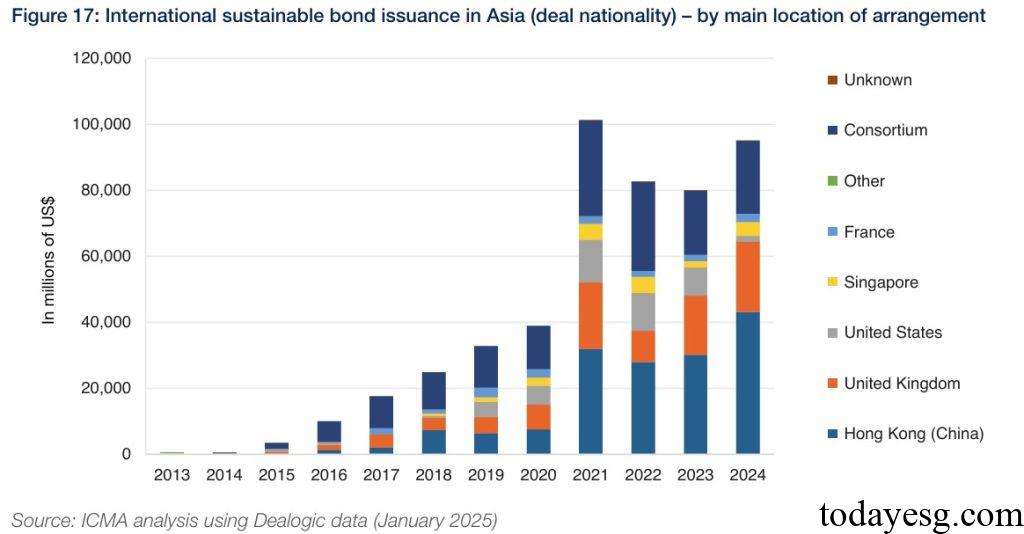

The total issuance volume of the Asian international sustainable bond market in 2024 is $99 billion, a year-on-year increase of 17%. The issuance of sustainable bonds in 2022 and 2023 decreased to $85 billion, lower than the peak in 2021. Mainland China holds a leading position in the Asian international sustainable bond market, with a sustainable bond issuance of $43 billion in 2024, accounting for 30% of the total issuance. The issuance proportions in South Korea, Hong Kong, and Japan are 15%, 11%, and 10%, respectively.

The Asian international sustainable bond market continues to lead in issuance, accounting for 21% ($99 billion) of the total issuance in the Asian bond market, compared to 9% ($610 billion) in other regions of the world.

From the perspective of issuance location, over one-third of sustainable bonds were issued in Hong Kong, China from 2021 to 2023, and this proportion has risen to 45% by 2024. This is mainly due to the continuous increase in issuance in mainland China and the ongoing impact of sustainable policies such as the Hong Kong Green Bond Program. In 2024, Hong Kong accounts for approximately 70% of the issuance locations in the entire Asian international bond market, making it the largest international bond issuance location in Asia and its proportion continues to increase.

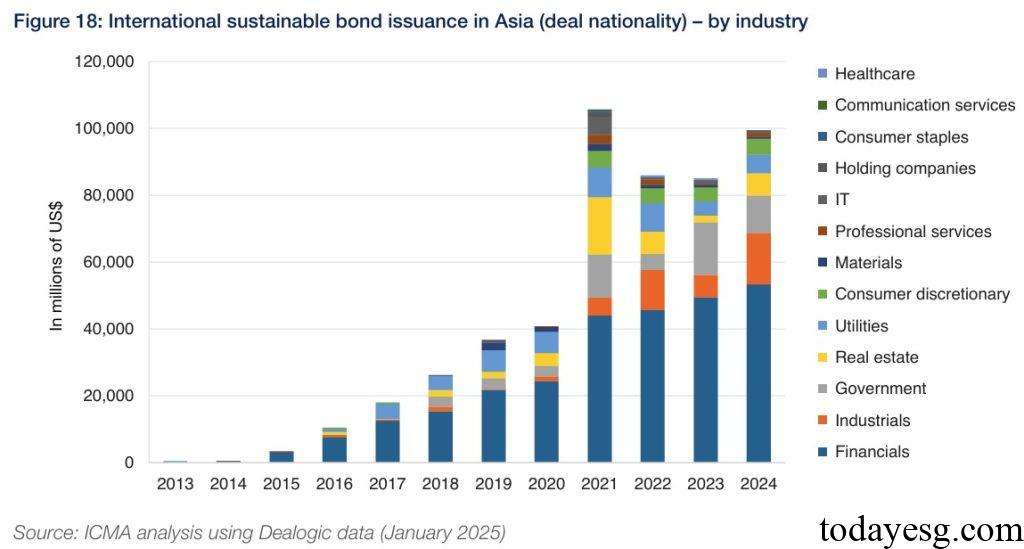

From the perspective of issuers, the largest issuers in the Asian international sustainable bond market are financial institutions, accounting for over 60% of the total issuance since 2014. The industrial and real estate industries have been ranked high since 2021.

Reference:

Asian International Bond Markets Issuance Trends and Dynamics