Report on Sustainability Assurance Market

The UK Financial Reporting Council (FRC) releases a report on the sustainability assurance market, aimed at analyzing the development of the sustainability assurance.

The UK FRC launches research in March 2024 aimed at analyzing participants, market development opportunities, and regulatory frameworks in the sustainability assurance market, and establishing a high-quality sustainability assurance market.

Related Post: IAASB Releases International Standard on Sustainability Assurance ISSA 5000

Overview of the Sustainability Assurance Market

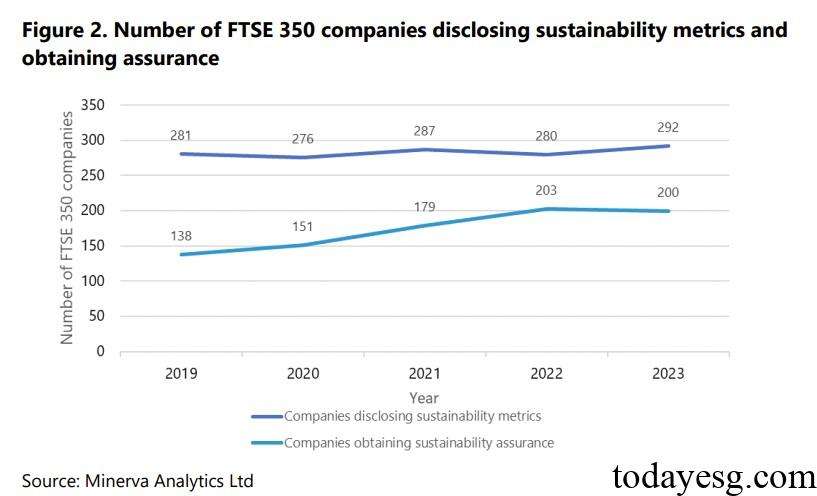

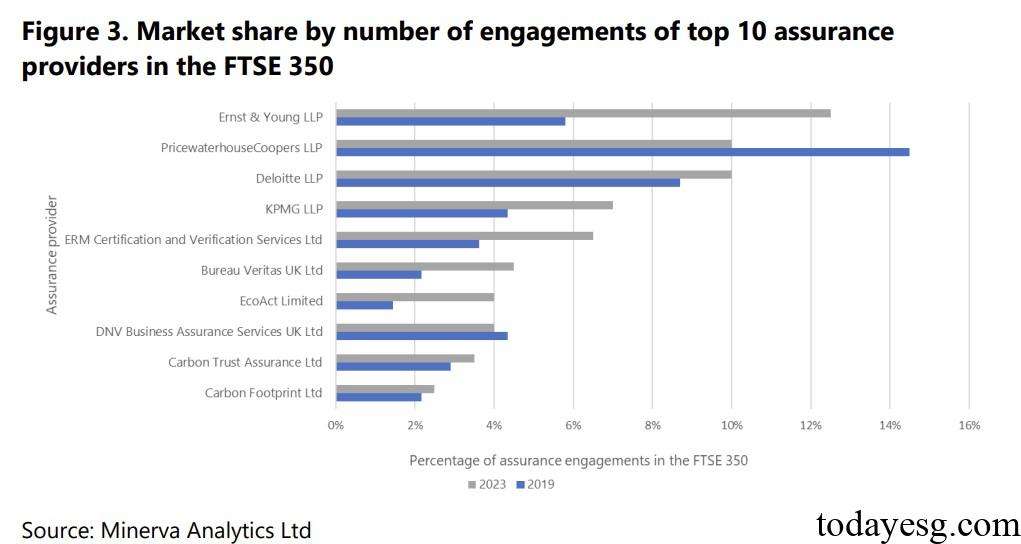

The UK FRC has studied the opinions of FTSE 350 constituents on the sustainability assurance market. Since 2019, the demand for sustainability certification from enterprises has increased by 18 percentage points. Enterprises tend to hire an auditing firm to provide sustainability assurance. The world’s top four accounting firms are the largest sustainability assurance providers, with their market share increasing from 33% in 2019 to 40% currently. 37% of companies hire the same auditing firm to provide auditing and sustainability assurance services.

In terms of assurance standards, 69% of enterprises refer to the International Standard on Assurance Engagements 3000 (ISAE 3000), with ISAE 3410 (35%) ranking second. In terms of assurance standards, 83% of enterprises choose limited assurance, which means conducting limited assurance on all or some indicators. Enterprises believe that with the increasing demand for sustainable certification of information disclosure from stakeholders, the sustainability assurance market will continue to develop.

A total of 292 companies in the FTSE 350 index disclose their sustainability indicators, of which 200 receive sustainability assurance. These assurances come from 59 suppliers, of which 40 only conduct one or two assurances that year, and 16 only provide assurances on greenhouse gas emission data. EY is the largest supplier of sustainability assurance services, with a market share of around 12%. The market share of the other three international accounting firms ranges from 6% to 10%. Since 2019, some companies have changed their providers, with the main trend being from non-audit firms to audit firms.

Characteristics of the Sustainability Assurance Market

The UK FRC summarizes the following characteristics of the sustainability assurance market through the above analysis:

- There are many sustainable certification suppliers, and participants are concerned about their consistency: Most companies choose based on indicators such as assurance quality, supplier scale, influence, and reputation, but some stakeholders express concerns about assurance quality due to the lack of regulatory frameworks and mandatory standards in the sustainable assurance market. It is difficult for stakeholders to compare the information provided by different types of suppliers, which may result in additional costs.

- Enterprises tend to use the Big Four accounting firms for sustainability assurance: The Big Four accounting firms have established cooperative relationships with constituents and provide traditional financial statement audit work. These firms have more professional capabilities to handle assurance services. The mandatory assurance requirements implemented by some other jurisdictions, such as the European Union, may also encourage companies to choose the Big Four accounting firms to cover a wider range of sustainable information and indicators. The sustainability reporting standards issued by the International Sustainability Standards Board (ISSB) have also added a link between sustainable information disclosure and financial information disclosure.

- The sustainable assurance market requires regulation, education, and communication: All companies believe that the sustainable assurance market will continue to develop, but existing market access and development barriers need to be addressed. Regulatory agencies need to improve the robustness of sustainable data for businesses and provide sustainable data skills and training to enhance the efficiency and effectiveness of assurance services. Some respondents suggest that the UK issue mandatory assurance requirements, designate a regulatory agency to provide a consistent regulatory framework for the market, and reduce compliance costs for participants.

Reference: