Discussion Paper on Scope 3

The Net-Zero Asset Owner Alliance (NZAOA) releases a discussion paper on Scope 3 at analyzing the importance of Scope 3 for asset owners in the net zero framework.

The Net-Zero Asset Owner Alliance believes that incorporating Scope 3 into carbon accounting is a challenging task, therefore all stakeholders need to collaborate to improve Scope 3 disclosure from multiple perspectives such as regulatory framework, data quality, and calculation methods.

Related Post: Asset Management Companies Plans to Establish Scope 4 Database

Importance of Scope 3 in Net Zero

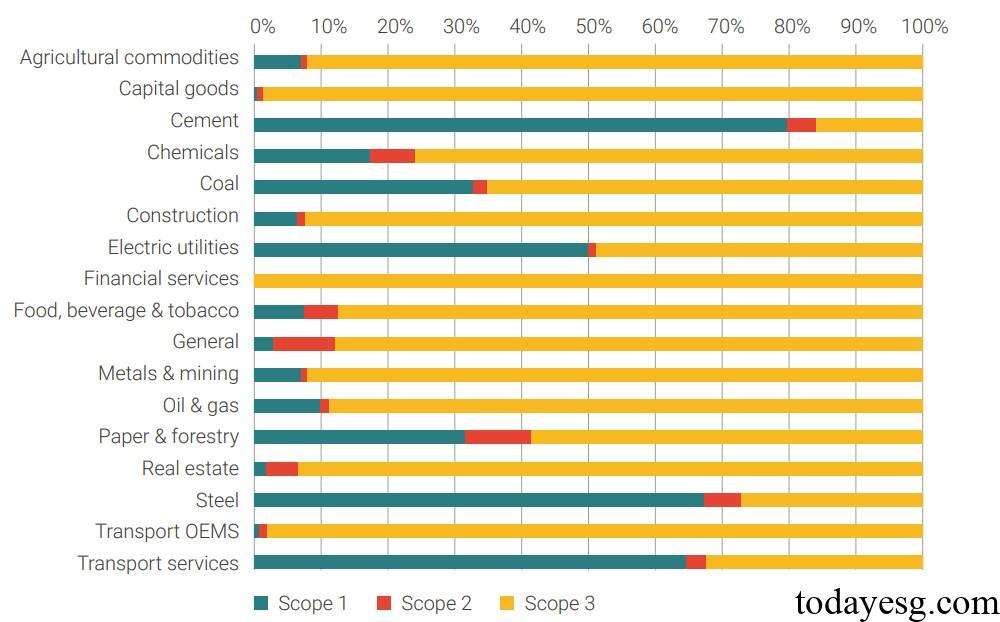

Members of the Net-Zero Asset Owner Alliance have committed to achieving net zero emissions from their investment portfolios by 2050, to meet the Paris Agreement’s 1.5 degree Celsius warming target. The Target Setting Protocol of the alliance stipulates that members should set targets for Scope 3 of their investment portfolio, including Scope 1 and Scope 2 of the investees. Due to 75% of a company’s greenhouse gas emissions falling under Scope 3, asset owners must consider the invested company’s Scope 3 in their net zero strategy to understand the actual carbon emissions of the investment portfolio.

Some regulatory agencies are incorporating Scope 3 into companies’ carbon emission disclosure requirements, such as the Partnership for Carbon Accounting Financials (PCAF) which requires companies and financial institutions to calculate Scope 1, Scope 2, and Scope 3. The Science Based Targets Initiative requires companies with a Scope 3 percentage of over 40% to set Scope 3 targets.

Challenges of Scope 3 Applications

The Net-Zero Asset Owner Alliance believes that the main challenges in applying Scope 3 in the investment portfolio are as follows:

In terms of carbon accounting, asset owners’ calculations mainly rely on disclosures from investees and estimates from data providers. The most recognized carbon accounting standard is Greenhouse Gas Protocol, which serves as the foundation for many carbon accounting frameworks, but there are still some application challenges. For example, there is a lot of room for interpretation of its accounting standards, and the interpretation of Scope 3 activities is mainly based on a qualitative perspective. The Greenhouse Gas Protocol also provides three methods for calculating carbon emissions: equity share, financial control, and operational control, which may yield different results.

In terms of data availability, accuracy, and consistency, Scope 3 has a relatively low proportion of disclosure, and its quality is also lower than that of Scope 1 and Scope 2. FTSE Russell conducted research on the constituents of the FTSE All-World index and found that 70% of companies disclosed Scope 1 and Scope 2, while only 45% disclosed Scope 3. Some studies suggest that different data providers provide Scope 3 estimates with low correlation based on different assumptions and explanations, resulting in significant errors for asset owners.

In terms of calculation, when Scope 3 is included in the accounting of multi-asset and multi-sector investment portfolios, it may result in duplicate calculations due to factors such as emission range, value chain, and asset category. These situations will affect the carbon emission data of asset owners, as well as the environmental impact of the invested company on the investment portfolio. The Greenhouse Gas Protocol recommends that asset owners should not aggregate Scope 3 data as total emissions, but report Scope 1, Scope 2, and Scope 3 separately.

How to Incorporate Scope 3 in Carbon Accounting

The Net-Zero Asset Owner Alliance believes that asset owners can incorporate Scope 3 in carbon accounting from the following perspectives:

- Disclosure ambition: Asset owners may request the investee to provide higher quality Scope 3 in order to improve portfolio coverage.

- Relying on companies with Scope 3 targets: Asset owners can invest in companies with validated Scope 3, and 96% of companies certified by SBTi have disclosed Scope 3.

- Engagement objectives: Asset owners can focus on companies in specific industries and actively engage with them. Specific industries refer to those with a high proportion of Scope 3 and significant impact on the environment.

- Specific sector targets: Asset owners can include Scope 3 in their industry emission reduction targets to avoid double counting.

- All-encompassing reductions: Asset owners can consider Scope 3 separately from Scope 1 and Scope 2 to avoid the impact of Scope 3’s absolute carbon emissions on the latter.

Reference: