Corporate Sustainability Report Directive Report

PwC releases a report on the EU Corporate Sustainability Reporting Directive, aimed at analyzing how companies apply the CSRD for information disclosure.

The EU Corporate Sustainability Reporting Directive is the foundation of the European Green Deal, which aims to achieve net zero greenhouse gas emissions by 2050 and establish a sustainable economic system.

Related Post: Global Reporting Initiative Releases Briefings on Corporate Sustainability Reporting Directive

Corporate Sustainability Reporting Directive Implementation Roadmap

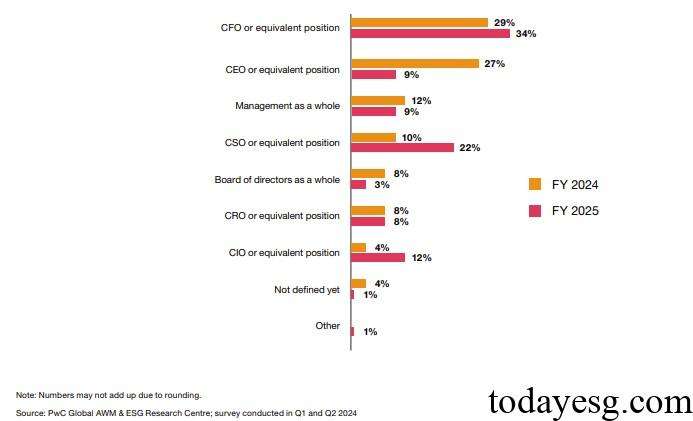

PwC conducted a survey of 215 EU companies to understand their progress in implementing the Corporate Sustainability Reporting Directive. In the fiscal year 2024, only 4% of respondents are ready to release reports, with data collection, concept understanding, and scope assessment accounting for 24%, 22%, and 18%, respectively. This indicates that most companies are still in the research stage of regulatory policies. In terms of C-suites involved in the report, CEOs, CFOs, and CSOs account for a relatively high proportion, reaching 40%, 33%, and 13% respectively. In the fiscal year 2025, the proportion of CSOs and CIOs has slightly increased.

In terms of respondents’ attitudes towards CSRD, 50% of companies consider it a strategic project in the 2024 fiscal year, while 63% of companies consider it a compliance project in the 2025 fiscal year. The reason for this change may be that the company has not yet realized the potential impact of the report on its long-term development. PwC considers the following stages in order to establish a roadmap for implementing the CSRD:

Scope:

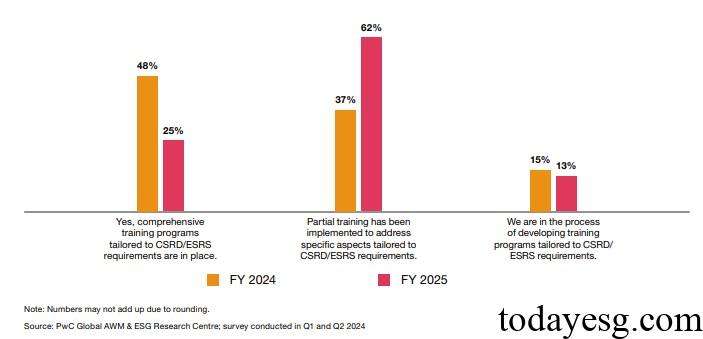

In the scope stage, the companies need to evaluate the scope of the report, that is, which subsidiaries will be included in the report. The Corporate Sustainability Reporting Directive specifies the revenue, total assets, and number of employees of enterprises, and will be implemented in stages from 2025 to 2029. In order to confirm the scope of the report, companies also need to undergo specific training. In the fiscal year 2024, half of the enterprises have implemented comprehensive training plans, and 37% of the enterprises have implemented partial training plans.

Double materiality assessment:

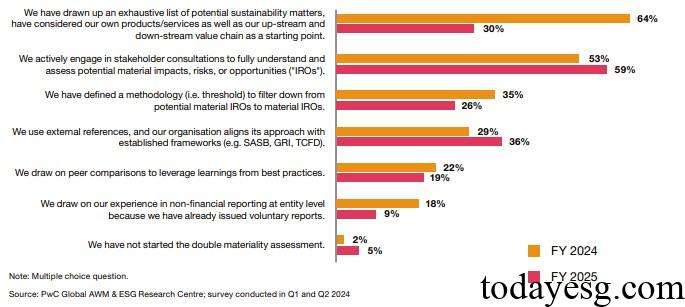

In the double materiality assessment stage, companies need to decide which information to disclose in the report, namely to determine the financial materiality and impact materiality of sustainable issues. Enterprises need to understand their business activities, identify sustainable impacts, risks, and opportunities, and assess whether these matters are material. In the fiscal year 2024, two-thirds of the companies have developed a detailed list of sustainable issues, half of the companies have communicated with stakeholders to confirm sustainable issues, and one-third of the companies have defined screening methods for materiality issues.

Data readiness assessment:

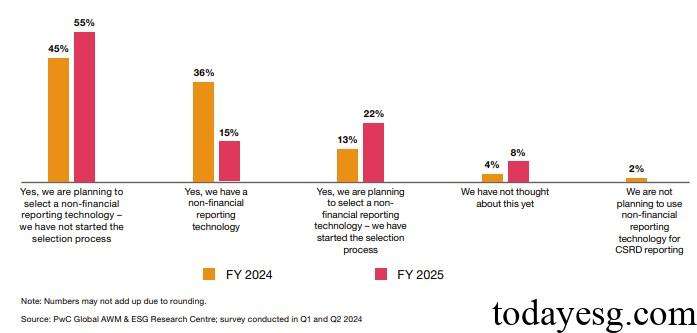

In the data readiness assessment stage, companies need to understand information such as data sources and data quality. In the fiscal year 2024, two-thirds of companies collect data from customer feedback and surveys, half of companies collect data internally, and 40% of companies collect data from third-party ESG data providers. Data quality, resource constraints, and data security are commonly recognized as challenges for enterprises. 36% of enterprises have already chosen data solutions, and 45% are planning to do so.

Implementation:

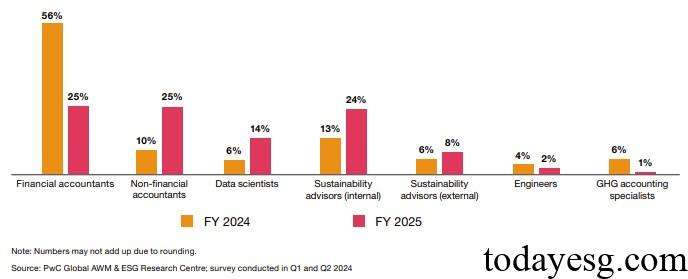

During the implementation phase, companies need to establish an information disclosure process to provide resources for preparing reports. In the fiscal year 2024, 56% of companies allocated 3-5 employees, and 27% of companies allocated 6-10 employees. Accountants and sustainable development consultants are the main categories of employees. In the fiscal year 2025, the company plans to continue increasing the allocation of sustainable development consultants.

Report:

During the reporting phase, companies need to release information and provide third-party assurance. In the fiscal year 2024, 44% of companies plan to provide report summaries to their auditors, and this proportion increases to 68% in the fiscal year 2025. In terms of report signing, CFO and CEO account for 29% and 27% respectively, indicating that these senior management roles are responsible for the overall report.

Reference:

CSRD Reporting as the Accelerator for Sustainable Business Transformation

ESG Advertisements Contact:todayesg@gmail.com