Climate Transition in China’s Agri-food Systems

The Climate Bonds Initiative (CBI) releases a report on climate transition in China’s agri-food systems, aiming to analyze how to promote the transition of China’s Agri-food Systems.

The Climate Bonds Initiative believes that achieving climate transition in the agri-food systems requires significant financial support. Currently, only 4.3% of global climate funds are invested in the agri-food systems, which is one seventh of the financing needs. In addition, there are a large number of small and medium-sized enterprises and farmers in the agri-food systems, and how to balance the interests of these groups and achieve fair transition is also a key concern.

Related Post: World Economic Forum Releases Report on Sustainable Food Production

Background of Climate Transition in China’s Agri-food Systems

The agri-food systems plays an important role in mitigating and adapting to climate change, accounting for one-third of GHG emissions and related to multiple United Nations Sustainable Development Goals. The greenhouse gas emissions from China’s agri-food systems have exceeded 1.9 billion tons of carbon dioxide, and with the increasing demand for food and nutrition in the future, emissions may continue to increase. It is expected that greenhouse gas emissions from agri-food systems will increase by 30% to 40% by 2050, leading to a more pronounced impact of climate change and directly affecting the production and consumption of agri-food systems.

The agri-food systems is highly sensitive to climate change, and when climate change leads to meteorological disasters, it will affect the stability of the agri-food systems. Research data shows that climate change has caused one-third of global crop yields to change, and if appropriate measures are not taken, climate change could reduce global food production by 5% to 30% by 2050. Climate change also affects the supply chain of the agri-food systems. From 2008 to 2018, China’s agricultural losses caused by extreme weather exceeded 970 billion RMB. Therefore, enhancing the resilience of the agri-food systems and resisting the impacts of climate change is necessary.

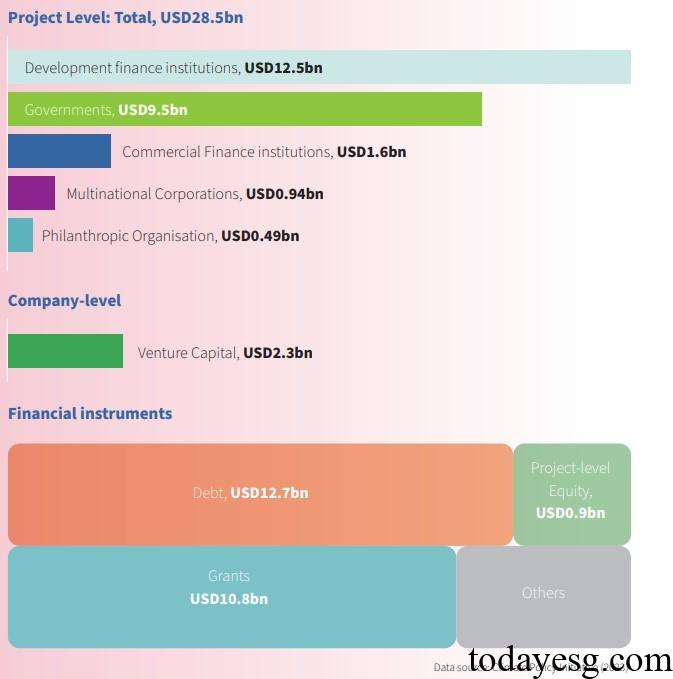

China’s Agri-food Systems and Transition Finance

Before 2030, the global agri-food systems will need $350 billion annually to achieve climate transition, with $28.5 billion invested annually in the agri-food systems. Development financial institutions ($12.5 billion), government ($9.5 billion), and venture capital ($2.3 billion) account for a relatively high proportion, with investment forms mainly including bonds ($12.7 billion), grants ($10.8 billion), and project equity ($ 900 million). The funding needs of China’s agri-food systems account for about 20% of the global demand, therefore there is a significant funding gap.

The difficulty of climate transition in the agri-food systems lies in its industry characteristics, such as long investment cycles and high uncertainty of returns, which make it difficult to attract a large number of investors. The higher financing costs weaken the ability of the agri-food systems to undergo climate transition, and transition finance may be an important tool to fill the financing gap.

Transition finance support for enterprises and projects that have not yet achieved green but have clear transition plans to support net zero transition is in line with the characteristics of the agri-food systems. The People’s Bank of China is formulating the standards for China’s transition finance, and agriculture has been included in the first batch of key industries.

Suggestions for Climate Transition in China’s Agri-food Systems

The Climate Bonds Initiative believes that climate transition in China’s agri-food systems can be considered from the following aspects:

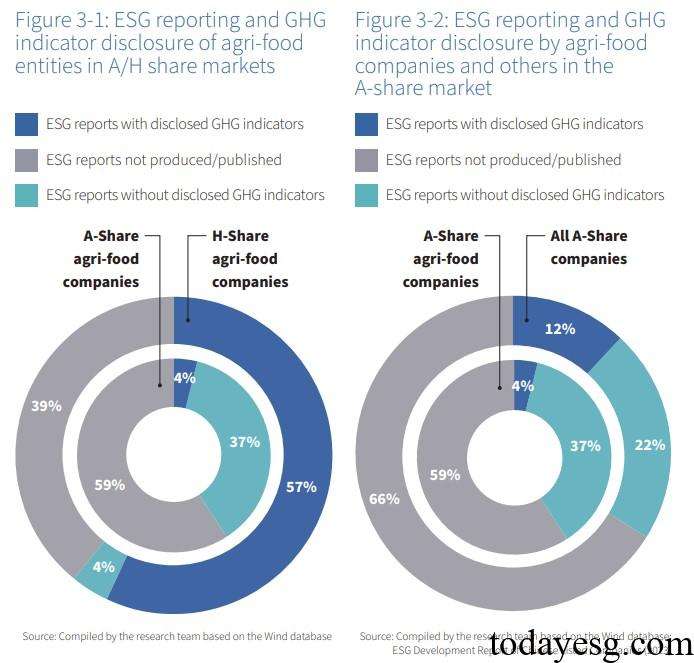

- Strengthen climate information disclosure: Financial institutions need to understand the greenhouse gas emissions information of the agri-food systems in order to assess their transition capabilities, so the agri-food systems need to disclose more information. Among the 187 agricultural and food companies listed on the A-share market, only 41% have disclosed ESG reports, of which only 4% have disclosed greenhouse gas emission targets, while the overall proportion of A-share companies disclosing greenhouse gas emission targets is 12%. Therefore, the agri-food systems needs to improve greenhouse gas accounting methods and enhance information disclosure capabilities.

- Develop a climate transition plan: As the main body of the transition, the agri-food systems needs to develop climate transition plans at the enterprise or project level to ensure that the transition activities can generate benefits. The lack of a credible transition plan may increase the difficulty of financing, making it difficult for investors to evaluate financing opportunities. The transition plan of the agri-food systems should cover short-term, medium-term, and long-term goals, transition paths, investment plans, and fair transition evaluation mechanisms.

- Enhance policy support: The characteristics of the agri-food systems itself require regulatory agencies to formulate support policies, such as combining agricultural subsidies with climate targets, providing financial tools to support agriculture, and strengthening the synergy between transition policies and inclusive finance policies. Regulatory agencies can also consider providing endorsement for the public transition activities, guiding more private capitals to invest in this field.

Reference:

Financing the Climate Transition in China’s Agri-food Systems