2024 ESG Trends Report

Euronext releases its 2024 ESG Trends report, aimed at analyzing the ESG performance of listed companies.

This report is based on over 97000 raw data points from 1729 listed companies Euronext, covering the years 2020, 2021, 2022, and 2023. Each listed company selects over 50 quantitative indicators, with a focus on its environmental, social, and governance development. Listed companies can verify and update data through Euronext’s Connect client portal.

Related Post: Euronext Launched a New ESG Index on Climate Change

Greenhouse Gas Emissions and Energy Management

Euronext analyzes the greenhouse gas emissions of listed companies, with a focus on Scope 1, Scope 2, and Scope 3 carbon emission data. The average carbon emissions of Scope 1 and Scope 2 in 2023 are 1103 kilotons, a decrease of 14% compared to 2021. The unit greenhouse gas emissions are 177 tons per million euros, a decrease of 25% compared to 2021. This data indicates that reducing greenhouse gas emissions will not affect the income of enterprises.

For Scope 3 carbon emissions data, a total of 581 companies disclosed in 2023, an increase of 57% compared to 2020. Scope 3 is directly related to the company’s value chain and it is difficult to accurately capture basic data. Euronext plans to improve its measurement, collection, and reporting methods in the future to enhance the accuracy of data.

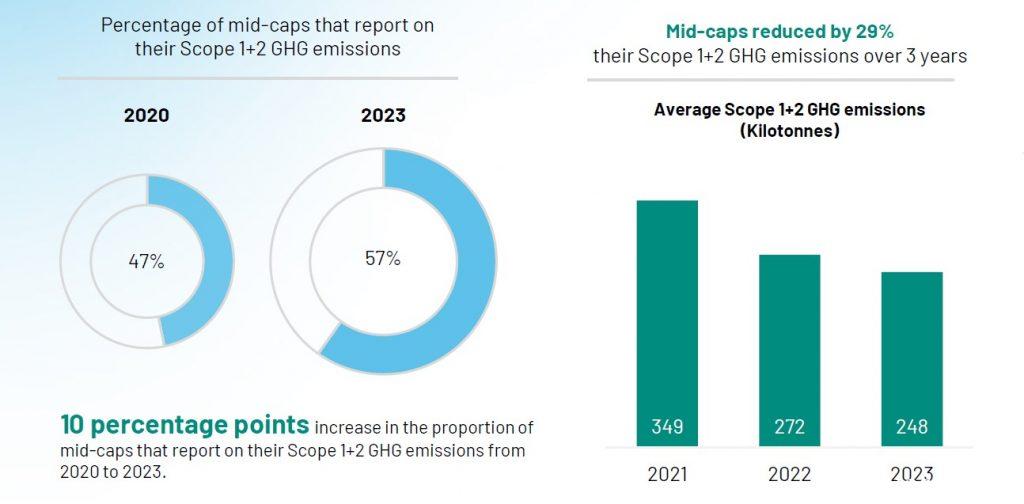

Euronext believes that 85% of large enterprises have disclosed their carbon emission data for several consecutive years, and the subsequent carbon reduction activities of medium-sized enterprises have become key to the market. In 2023, 57% of medium-sized enterprises disclosed their Scope 1 and Scope 2 data, an increase of 10 percentage points compared to 2020. The average greenhouse gas emissions of Scope 1 and Scope 2 for medium-sized enterprises decreases from 349 thousand tons in 2021 to 248 thousand tons in 2023.

In terms of energy management, 690 listed companies report sustainable energy development in 2023, an increase of 13% compared to 2020. The consumption and production share of renewable energy has increased from 37% in 2021 to 44% in 2023. Large enterprises have shown remarkable performance in this field, with a 13% reduction in energy consumption and a 26% decrease in energy intensity within three years, while their revenue has increased by 18%. This indicates that there is no apparent conflict between sustainable energy management and business operations.

Diversity and Inclusion Situation

Euronext analyzes the development of diversity and inclusivity in listed companies by measuring the gender diversity of their boards of directors and management bodies. The gender diversity of the board of directors in 2023 is 34.6%, an increase of 2.1 percentage points compared to 2021. The proportion of women in management institutions increases from 25.5% in 2021 to 27.1% in 2023.

Euronext uses the French Professional Equality Index to evaluate the diversity and inclusivity of French listed companies. This index has increased from 86.3 in 2021 to 88.9 in 2023.

Application of EU Taxonomy

Euronext investigated the proportion of information disclosure by listed companies based on the EU Taxonomy. 70% of large enterprises make disclosures based on the EU Taxonomy in 2023, an increase of 18 percentage points compared to 2021. The disclosure ratio of medium-sized enterprises is relatively low, with 49% of large enterprises disclosing based on the EU Taxonomy in 2023, an increase of 19 percentage points compared to 2021.

The EU Corporate Sustainability Reporting Directive requires large listed companies to make disclosures based on the EU Taxonomy in 2024, while small and medium-sized enterprises will make disclosures in stages in 2026. It is expected that the information disclosure ratio of medium-sized enterprises will continue to increase in the future.

Reference: