Report on Steel and Cement Industries Transition

The Climate Bonds Initiative (CBI) has released a report on the transition of the steel and cement industries, aiming to analyze how to achieve the transition plan of the steel and cement industries based on climate bond methodology and meet the financing needs for transition.

In order to help investors allocate transition assets, the Climate Bonds Initiative has released the Climate Bonds Taxonomy to identify whether assets are aligned with transition trajectories.

Related Post: Introduction to the Climate Bonds Taxonomy Released by Climate Bond Initiative

Carbon Emissions in Steel and Cement Industries

The steel and cement industries are the two largest sources of industrial carbon emissions in the world, accounting for 7% and 6% of the total global carbon emissions, respectively. Although the carbon emission data of the two are similar, the carbon emission processes of the steel industry and the cement industry are different.

The carbon emissions of the steel industry mainly come from the coal used in blast furnace steelmaking and electric arc furnace steelmaking. Among them, one ton of steel produced by blast furnace emits 2.3 tons of carbon dioxide, and one ton of steel produced by electric arc furnace emits 0.7 tons of carbon dioxide. The carbon emissions of the cement industry mainly come from the chemical calcination process (accounting for 60%). One ton of cement produces approximately 0.9 tons of carbon dioxide from raw materials to final products.

Using the carbon dioxide generated per unit of income as an indicator, the cement industry generates 6.9 kilograms of carbon dioxide per 1 dollar of income, which is higher than the steel industry’s (1.4 kilograms of carbon dioxide per 1 dollar of income). The service life of steel and cement assets usually exceeds 40 years, and their current decarbonization progress is still below the target of the Paris Agreement. Long term maintenance of the status quo may lead to an increase in stranded assets in the future, which will have a negative impact on the development of the industries.

Transition Financing in Steel and Cement Industries

The Climate Bond Initiative predicts that in order to achieve net zero emissions by 2050, the steel industry will require $55 billion to $58 billion in funding annually, and the cement industry will require $28 billion to $36 billion in funding annually. As an essential tool for transition financing, sustainable bonds can play a crucial role in financing the transition of the steel and cement industries.

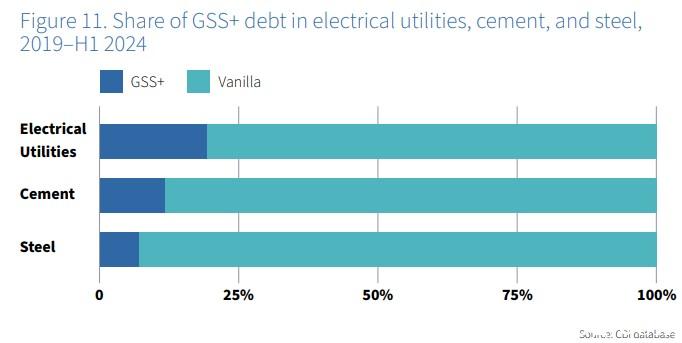

As of June 2024, the total issuance size of the global sustainable bond market reached $5.5 trillion, of which 80% is consistent with the climate bond methodology. However, the issuance of sustainable bonds in the steel and cement industries is insufficient, accounting for only 7.2% and 11.8% of the total bond issuance scale of both industries. In contrast, the issuance scale of sustainable bonds in the power industry has reached 20%. This difference mainly comes from the fact that the power industry has already formulated a detailed transition path, which can attract more investors.

Transitions Plan in Steel and Cement Industries

In order to evaluate the transition and development of the steel and cement industries, the Climate Bond Initiative analyzes the transition plans released by 10 steel companies and 10 cement companies, whose market share reached 40% and 20%, respectively. Among the 10 steel companies, 50% have set transition goals that comply with the climate bond methodology, and 50% have developed action plans that comply with the climate bond methodology. Among the 10 cement companies, 40% have set transition goals that comply with the climate bond methodology, and 60% have developed action plans that comply with the climate bond methodology.

Just transition is an important concept in the transition process, which can predict, evaluate, and solve transition risks, and is crucial for the transition of the steel and cement industries. The Climate Bond Initiative finds that 40% of businesses have made clear commitments to just transition, and 45% have mentioned commonly used definitions or frameworks for just transition. 25% evaluated the impact of just transition on external stakeholders, and 15% evaluated the impact of just transition on internal stakeholders of the enterprise. However, these enterprises are still in the early stages of just transition, and relevant transition actions and external reports are still being formulated.

Reference: