2025 Asset Owner Impact Investing Report

The Global Impact Investing Network (GIIN) releases 2025 Asset Owner Impact Investing Report, which aims to summarize the development of asset owner impact investing.

This report is based on 22 global asset owners, whose AUM reaches $3.5 trillion.

Related Post: Global Impact Investing Network Releases 2024 Impact Investment Market Report

Introduction to Asset Owner Impact Investing

Impact investing refers to investments that generate positive, measurable social and environmental impacts and generate financial returns. The Global Impact Investing Network believes that the size of the global impact investing market reaches $1.57 trillion in 2024. This report introduces the role of asset owners in the market in the following aspects:

- Financial expectations: Respondents believe that impact investing needs to have the same financial expectations as traditional investing, that is, adopting impact investing will not sacrifice investment returns. In impact investing activities, investors need to maintain competitive financial performance. Impact investing may require investors to take higher risks (as catalytic capital), or it may bring excess financial returns by exploring investment opportunities that traditional investment methods may miss.

- Impact commitments: All respondents have established impact investing priorities that are key areas of focus for investors and are related to social and environmental issues in different ways. Among the 22 respondents, 17 developed qualitative indicators, 3 developed quantitative indicators, and 2 developed both qualitative and quantitative indicators simultaneously. Climate and energy are the top priorities, with some investors incorporating these investments into their broad climate transition strategies, while others include them as part of their impact investing portfolios.

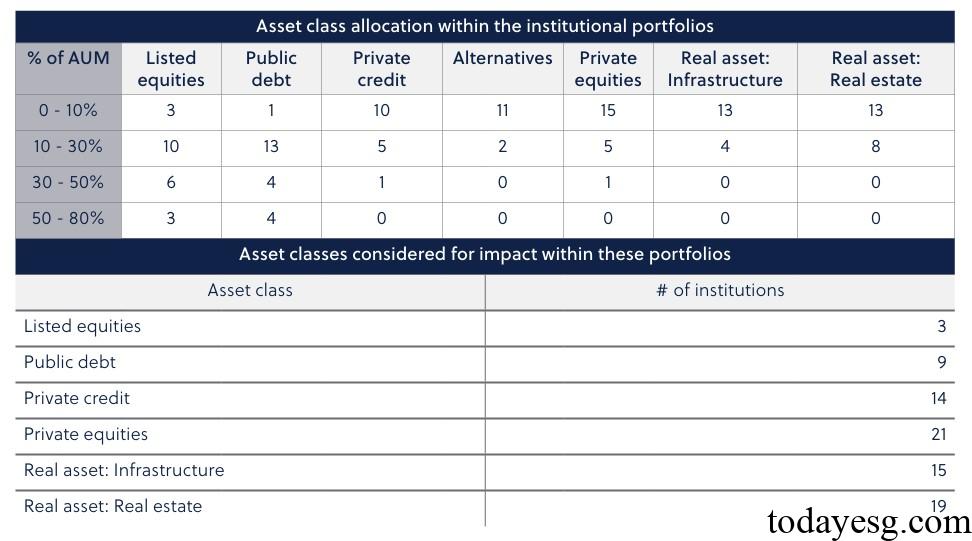

- Asset allocation for impact: Half of the respondents have already announced specific investment portfolio allocation goals, but most investors’ impact assets account for less than 5% of total assets, and only some small institutions (with impact investing as the core) have an allocation ratio greater than 20%. In terms of asset classes, most investors choose private equity, private credit, infrastructure, and real estate, with less allocation to traditional stocks and bonds. More than half of asset owners allocate influential assets by seeking asset managers.

- Managing for impact: Many investors mention influence in public documents, but do not incorporate it into core investment concepts, policies, and governance structures. 19 investors mentioned impact investing on the website, but only 10 directly mentioned it in their sustainable development policies. Due to the inconsistent definition of impact investing globally, many institutions face challenges in classifying impact assets, including determining the threshold for impact investing and determining impact contributions.

Reference: