2024 Swiss Sustainable Investment Market Report

Swiss Sustainable Finance releases 2024 Swiss Sustainable Investment Market Report, aimed at analyzing the development of the Swiss sustainable investment market.

Swiss Sustainable Finance adopts the sustainable investment classification method proposed by the Eurosif, which can effectively classify different categories of sustainable investment.

Related Post: Swiss Sustainable Finance Releases 2024 Swiss Impact Investment Market Report

Overview of Swiss Sustainable Investment Market

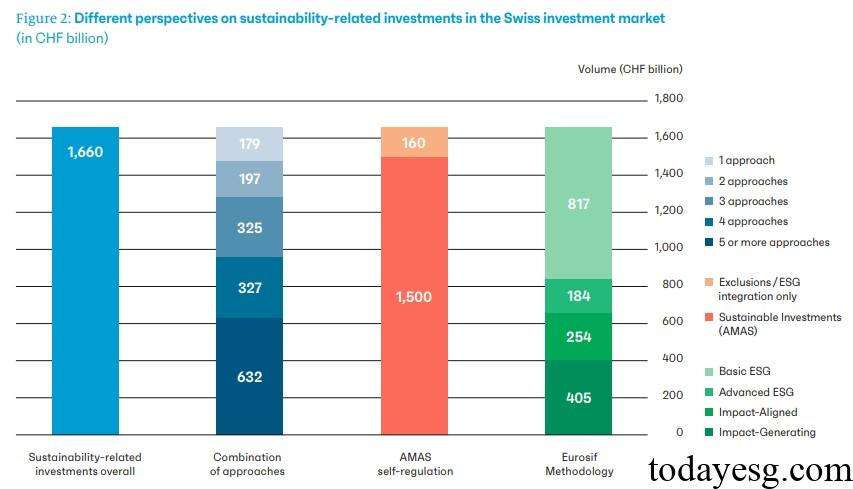

As of the end of 2023, the total size of the Swiss sustainable investment market was 1.67 trillion CHF, an increase of 3% compared to the previous year, but still lower than the historical high of 1.98 trillion CHF in 2021. The Swiss Sustainable Finance measures the composition of the sustainable investment market from three perspectives:

- Firstly, based on the quantity of sustainable investment methods. The market size using three or more sustainable investment methods is 1.28 trillion CHF, accounting for 77% of the total market size, an increase of 7 percentage points compared to the previous year, reflecting the development trend of more types of sustainable investment methods in the market.

- Secondly, based on the Asset Management Association Switzerland (AMAS) classification method. The market size that meets the definition of sustainable investment is 1.5 trillion CHF, accounting for 94% of the total market size. The remaining 160 billion CHF are classified using exclusion or ESG integration methods.

- Thirdly, based on the sustainable investment classification of the Eurosif. The market sizes for Basic ESG, Advanced ESG, Impact Aligned, and Impact Generating categories are CHF 817 billion, CHF 184 billion, CHF 254 billion, and CHF 405 billion, respectively.

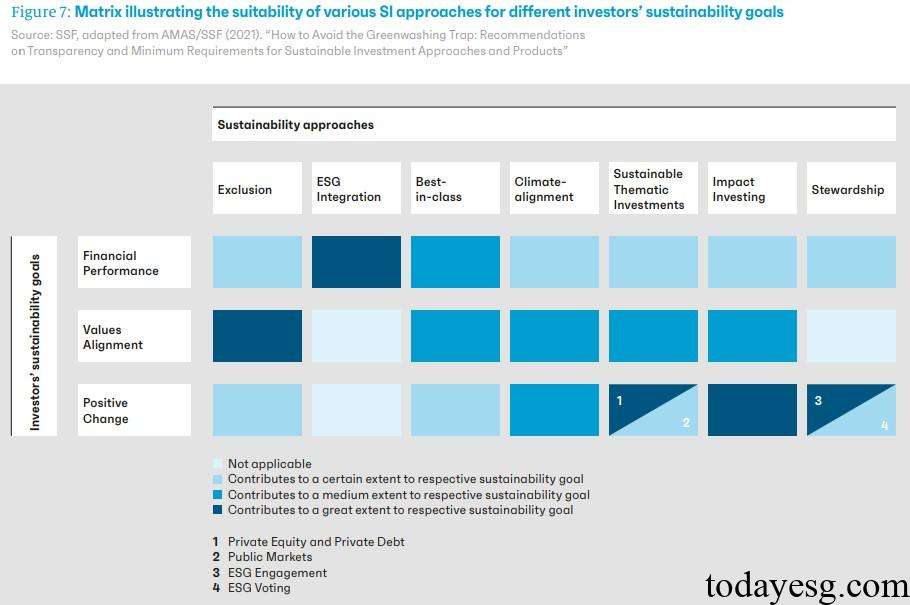

The Swiss Sustainable Finance has defined a total of nine sustainable investment methods, which can be mapped to three investment objectives. These investment objectives include financial performance, value alignment, and positive change. Each sustainable investment method has a different impact on investment objectives, and the mapping between these investment methods and investment objectives is as follows:

Swiss Sustainable Investment Market Analysis

From the perspective of investor categories, institutional investors remain the dominant force in the sustainable investment market, with assets worth 1.2 trillion CHF, accounting for 72% of the total market size. The asset size of private investors is 468 billion CHF, accounting for 28%. From the proportion of sustainable funds in the entire fund market, 51% of funds are sustainable funds in 2023, a decrease of 1 percentage point compared to the previous year. This may be due to some asset management companies tightening the standards for sustainable funds.

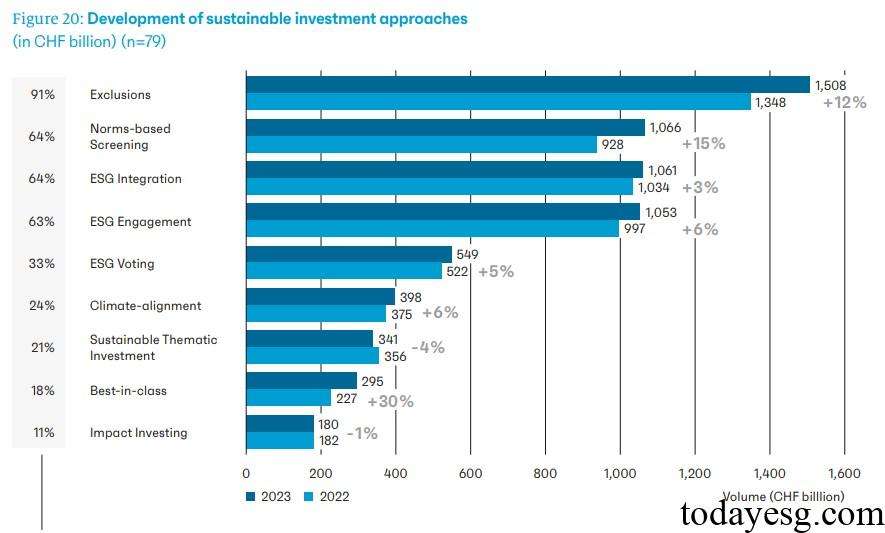

The EU Sustainable Finance Disclosure Regulation (SFDR) requires asset management companies to disclose information about funds. Currently, 57% of sustainable funds are following the Sustainable Financial Disclosure Regulation, with Article 6, Article 8, and Article 9 accounting for 6%, 39%, and 12%, respectively. In terms of the application of sustainable investment methods, the market share of exclusion (91%), normative screening (64%), ESG integration (64%), and ESG engagement (63%) is the highest, while the market share of sustainable thematic investment (21%), best in class (18%), and impact investment (11%) is the lowest.

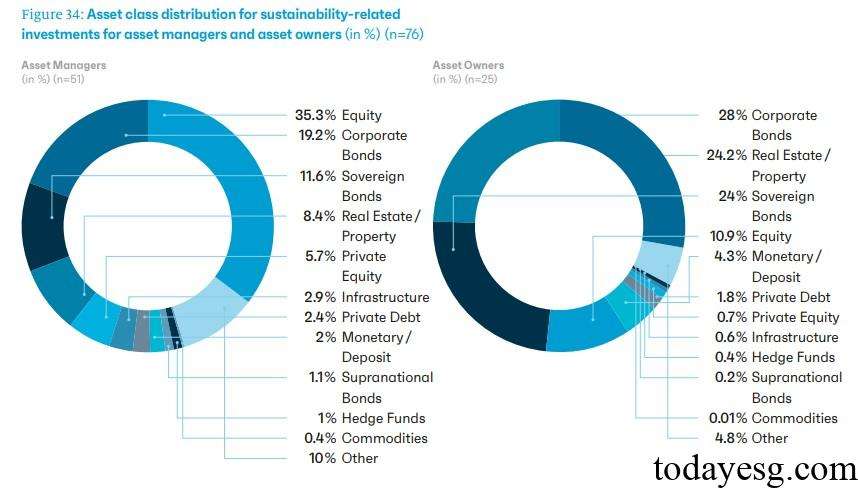

In terms of sustainable investment asset classes, equities (CHF 466 billion), corporate bonds (CHF 319 billion), sovereign bonds (CHF 215 billion), and real estate (CHF 177 billion) account for a relatively high proportion. Among them, equities, corporate bonds, and sovereign bonds account for a total of 77%. There is a difference in the allocation between asset managers and asset owners, with asset managers’ primary asset allocation being equities (35%) and asset owners’ primary asset allocation being corporate bonds (28%). The reason for this difference may be that pension funds and insurance companies among asset owners tend to hold more fixed income assets.

Reference: